Here is some of what you own – and part of your £½ TRILLION liabilities

Part II of our exclusive report into the body supervising massive amounts of our money

Montage © Facts4EU.Org 2024

From NatWest to the Post Office to Sizewell C, the UKGI oversees our investments

In Part I of this report we revealed the body responsible for overseeing the public’s huge investments in 24 different organisations, from the Post Office to NatWest. We showed that the contingent liabilities on the British public amount to more than £½ TRILLION.

In today’s report (Part II) we detail more of the organisations in which the British public has a stake.

A Brexit Facts4EU.Org Two-Part Report

Part I : The body responsible for over £½ TRILLION of our public liabilities

Part II : From NatWest to the Post Office, we reveal more of the public investments UKGI is supervising (This report)

Some of the investments you are tied up in

All of the descriptions below come from the UKGI. We have only changed the order to reflect people's interests and we added logos. All logos are the copyright of each organisation listed.

Brexit Facts4EU.Org Summary

Public investments being supervised by UKGI

The Post office is the UK’s largest retail network and the largest financial services chain in the UK with more branches than all of the UK’s banks and building societies put together.

[Note: Yesterday HM Charles III formally removed the honour of a CBE for the ex-CEO of the Post Office, over the scandal of the prosecution of so many sub-postmasters on erroneous grounds. The UKGI was overseeing the Post Office during this period.]

Natwest Group is a UK-based financial services company, head-quartered in Edinburgh. NatWest Group provides a wide range of products and services to personal, commercial and large corporate and institutional customers through its two main subsidiaries, NatWest and The Royal Bank of Scotland, as well as through a number of other well-known brands including Ulster Bank and Coutts.

Channel 4 is a commercially funded public sector broadcaster it operates a portfolio of channels including channel 4.

The Department of Health and Social Care (DHSC) and the devolved administrations - Clinical negligence claims provide for future costs in cases where they, or relevant NHS providers, are the defendant in legal proceedings, brought by claimants seeking damages for the effects of alleged clinical negligence. NHS Resolution, an arm’s-length body of DHSC, handles claims relating to the NHS in England. Expected cost £128bn

Sizewell C will generate enough low-carbon electricity to supply six million homes. By replacing fossil-fuel power, it will avoid around nine million tonnes of carbon emissions each year. It will create thousands of local jobs and contribute around £4 billion to the regional economy. The project will support 70,000 jobs across the UK and rely on over 3,000 UK-based suppliers.

HM Land Registry registers the ownership of land and property in England and Wales and is a non-ministerial department.

The British Business Bank is a government owned business development bank dedicated to making financial markets work better for small businesses.

Nuclear Decommissioning Authority (NDA) ensures the safe and efficient clean-up of the UK’s nuclear legacy. NDA is an executive non-departmental public body, supported by 4 agencies and public bodies.

National Nuclear Laboratory ‘s purpose is to serve the national interest and create value for customers by pushing the boundaries of science, technology and innovation.

Ordnance Survey’s aim is to provide mapping that informs, guides and inspires. Its vision is to reveal our ever-changing landscape in extraordinary detail, giving the most comprehensive view of Britain.

The Royal Mint is the world’s leading export mint, making coins and medals for an average of 60 countries every year. However, its first responsibility is to make and distribute United Kingdom coins as well as to supply blanks and official medals.

UK Export Finance is the UK’s export credit agency and a government department . It works with 70 private credit insurers and lenders to help UK companies access export finance.

UK Asset Resolution (UKAR) was established on 1 October 2010 to facilitate the orderly management of the closed mortgage books of both Bradford & Bingley and NRAM.

URENCO is an international supplier of enrichment services and fuel cycle products. With plants in Germany, the Netherlands, the UK and in the USA, it operates in a pivotal area of the nuclear fuel supply chain which enables the sustainable generation of electricity for consumers around the world. The URENCO Group provides safe, cost effective and reliable uranium enrichment services for civil power generation within a framework of high environmental, social and corporate responsibility standards.

Eutelsat Group is the world’s first GEO-LEO satellite operator, listed in Paris and London, providing video and connectivity services to customers around the globe. The UK Government became a shareholder in September 2023 following the merger of Eutelsat with OneWeb, the UK-based Low Earth Orbit satellite communications company.

Reclaim Fund Ltd (RFL) is the UK’s operator of the Dormant Assets Scheme. Working with the financial services industry, RFL facilitates the transfer of dormant asset monies into the Scheme ensuring the original owner’s right to reclaim and distributing the surplus funds (amounts in excess of what is required to meet future reclaims), to social and environmental initiatives across the UK.

AWE (the Atomic Weapons Establishment) plays a crucial role in nuclear defence, providing the warheads for the UK’s nuclear deterrent.

The UK Infrastructure Bank (UKIB) is the new, government-owned policy bank, focused on increasing infrastructure investment across the United Kingdom. It will partner with the private sector and local government to finance a green industrial revolution and drive growth across the country.

Former Secretary of State The Rt Hon Sir John Redwood, MP for Wokingham, MP commented on our report

"There are plenty more Brexit benefits to come if government will use our new freedoms well. UKGI is a treasure trove of losses and incompetence, all run by well paid officials. No wonder taxes are so high and public spending so bloated. The state bought too many expensive bonds they are now losing on, fails to sell enough train tickets, has no successful business plan to use the Post Office network, faces large numbers of claims over bad NHS care and owns various loss making businesses."

- The Rt Hon Sir John Redwood, MP for Wokingham, commenting to Facts4EU.Org and CIBUK.Org, 24 Feb 2024

The public’s £½ TRILLION liability for all of this

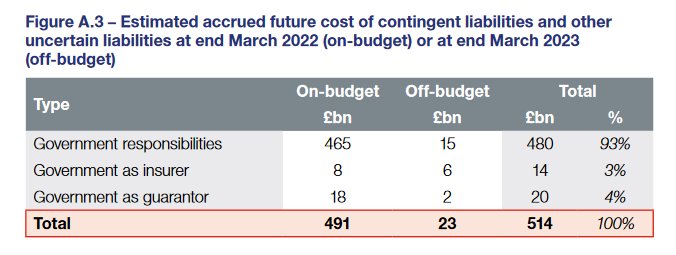

In its latest report the UKGI talks about the overall liabilities of the public. They say :-

“We found that central government departments reported £491bn of risk arising from contingent liabilities and provisions in line with accounting standards. We also know from the data that has been compiled by the CLCC that government is responsible for a further 933 contingent liabilities and that this represents £23bn of risk which, while not new, has not previously been quantifiable.”

As we reported in Part I, this brings the total to £0.514 TRILLION pounds

© Crown 2024 - click to enlarge

What's missing from all the above?

Actually, a lot of things. Here we will mention just two.

- Network Rail - The Department for Transport’s (DfT) Network Rail inter-public sector guarantee has been excluded by the UKGI "as it is an intra-departmental financial guarantee". This is of course a massive item.

- The Bank of England’s (BoE) Asset Purchase Facility (BEAPFF) - The UKGI say that this "This has been excluded as financial derivatives are outside the scope of our analysis.". To give readers some idea of the magnitude, here is what the UKGI said in their last annual report:

"Following rises in interest rates in 2022 and 2023, the facility started to make cash losses which are the responsibility of HM Treasury to pay. HM Treasury paid out a total of £5bn between October 2022 and January 2023. The fair value of the derivative liability as at 31 March 2023, as presented in HM Treasury’s accounts, is £177.6bn. This amount broadly represents the money that HM Treasury would need to pay out if all of the BEAPFF’s assets were sold at fair value and the liabilities commuted."

In short, the public's liabilities are even higher - by a long way - than those indicated in the UKGI's report.

Observations

Yesterday at the CPAC conference just outside the Washington DC beltway, former PM Liz Truss made a speech extolling a low tax, small state approach to managing the country. Yes, she voted Remain but now she is firmly behind the vote and the values of so many across the country.

In this two-part report we have attempted to shed some light on a quango which is supposed to be overseeing the public's massive investments in numerous organisations. In our report yesterday, former Secretary of State Sir John Redwood MP gave readers his thoughts. In his view this quango (UKGI) should be abolished and its powers handed back to the various government departments which should be controlling this use of public money.

As we are in favour of slimmed-down government, we concur.

Facts4EU.Org really, really needs you today

We are a 'not for profit' team (we make a loss) and any payment goes towards the actual work, not plush London offices, lunch or taxi expenses, or other luxuries of some organisations.

We badly need more of our thousands of readers to become members, to support this work. Could this be you, today? It's quick and easy, we give you a choice of two highly secure payment providers, and we do NOT ask you for further support if you pay once. We just hope you keep supporting us. Your membership stays anonymous unless you tell us otherwise.

Please don't assume that other people will keep us going - we don't receive enough to survive and we need your help today. Could you help us? We rely 100% on public contributions from readers like you.

If you believe in a fully-free, independent, and sovereign United Kingdom, please join now by clicking on one of the links below or you can use our Support page here. You will receive a personal, friendly ‘thank you’ from a member of our team within 48 hours. Thank you.

[ Sources: UKGI ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Sat 24 Feb 2024

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget actually to post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments