You’d think you might know who is supervising £½ TRILLION of our liabilities

Revealed : The body responsible for overseeing massive losses in the public sector

Montage © Facts4EU.Org 2024

A two-part Facts4EU.Org report, including an article by the Rt Hon Sir John Redwood MP

Today we reveal who is overseeing the massive losses being incurred in the public sector. This body is barely known yet it supervises contingent liabilities of more than £½ TRILLION of public money. It monitors organisations such as NatWest, the Post Office, and Network Rail, amongst a portfolio of 24 public ‘assets’.

We also publish a call from former Secretary of State the Rt Hon Sir John Redwood MP to abolish this organisation altogether, removing what he sees as a superfluous tier of bureaucracy, and giving back the supervision directly to the government departments responsible for each area of expenditure. We are grateful to Sir John for drawing our attention to this matter.

A Brexit Facts4EU.Org Two-Part Report

Part I : The body responsible for over £½ TRILLION of our public liabilities (This report)

Part II : From NatWest to the Post Office, we reveal 24 public investments UKGI is supervising

Had you ever heard of Manvinder (“Vindi”) Singh Banga?

No, we hadn’t either. Punjab-born and educated Mr Banga is the Chairman of UK Government Investments Ltd (UKGI), the governance and corporate finance arm of the UK Government. He earns in excess of £250,000 per year – much more than Prime Minister Rishi Sunak.

In effect, this is the vehicle used by the Government to manage its investment of our money in a variety of publicly-funded organisations such as the Post Office and Network Rail.

It costs £24m per annum just to fund the UKGI staff and management infrastructure, to say nothing of the costs to the taxpayer of the losses in the operations it manages where public money is involved.

The public’s liabilities now amount to more than 0.5 TRILLION pounds

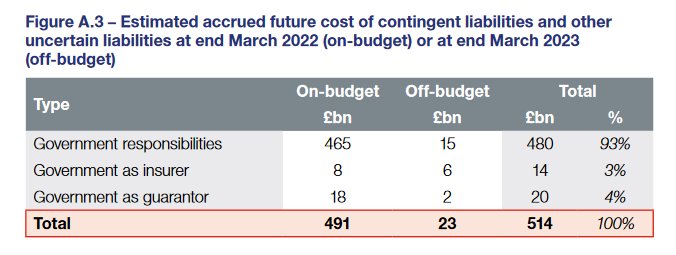

Below is a table taken from the latest set of accounts from the UKGI. It clearly shows that the contingent liabilities for these investments of public money exceed 0.5 TRILLION pounds.

© Crown 2024 - click to enlarge

What is a ‘contingent liability’?

In the words of the UKGI itself:

“A contingent liability represents a government commitment to possible future expenditure if specific conditions are met or unforeseen events occur, such as loans guarantee (where government agrees to pay the debts of a third party if they default, such as the Export Development Guarantee (EDG) schedule run by UK Export Finance) and indemnities (protection similar to insurance where government agrees to cover costs such as clinical negligence claims against NHS GPs).”

In layman’s terms, a contingent liability means we are all ‘on the line’ for this money, if things go bad.

UKGI is now managing a portfolio of 24 ‘assets’ on behalf of the public

In the summary of their latest annual report the UKGI says :-

“Over the year we have taken on a new role for Sizewell C and a monitoring role for BBC Commercial. We successfully completed our role with the UK Green Investment Platform, with the corporate vehicle being liquidated following the successful disposal of its remaining entities. We have continued to strengthen UKGI as a centre of excellence for corporate governance across government by promoting our model and maintaining and sharing our knowledge and expertise.”

When it comes to being “a centre of excellence for corporate governance” we suggest the UKGI speaks to all the sub-postmasters whose lives have been ruined, or to the NatWest customers who have been debanked.

A disturbing guest article by the Rt Hon Sir John Redwood, MP for Wokingham

There now follows some shocking information, summarised perfectly, about how your money is being wasted. In our guest article below, former Secretary of State the Rt Hon Sir John Redwood MP summarises the losses in some of the organisations where public money has been invested – and lost.

UK Government Investments Ltd piles high the losses for the public

A disturbing guest article by the Rt Hon Sir John Redwood, MP for Wokingham

UK Government Investments Ltd is another of these 100% government-owned, arms-length bodies. It is meant to supervise and manage the government’s substantial holdings in nationalised businesses and its stakes in private sector companies.

Last year to March it ran up costs of £23.4m, paying its CEO over £260,000 and its staff a median salary of £91,000. The Treasury made £24m available to it to pay the bills. The auditor agreed it is a going concern because the Treasury will make cash available to pay the losses.

So what magic did we get for this expenditure? Why not rely on departmental supervision of these bodies which happens as well, with Ministers being more involved? Just look at what has been happening under UKGI’s stewardship.

© Crown 2024 - click to enlarge

The Post Office

PO has accumulated losses of £1.39 billion. It has presided over the calamity of the sub-postmaster accounting system. Recent stories suggest senior management is still not resolving the issues rapidly enough despite ministerial policy to do so.

Network Rail

Despite owning all the track and stations with a monopoly, the remaining net asset value of Network Rail is just £15bn. £55bn has been expensively borrowed against its network assets. It lost £1.14bn last year.

The British Infrastructure Bank

A relatively new venture, this bank lost £21.4m last year with costs of £35.8m. It is planning to commit £22bn to investments, with £10bn of that being guarantees and the rest debt and equity underwritten by taxpayers. The Bank does not expect to be profitable anytime soon. I expect it will be able to deliver that forecast.

Sheffield Forgemasters

This is a government-owned defence supplier. It lost £5m pre-tax last year but does have positive assets and provides some important products.

NatWest

UK Government Investments says it engaged with NatWest as shareholder over its culture and values. It was very quiet over the leaks from NatWest and the resignation of the Chief Executive. Clearly its engagement did not prevent serious problems.

OneWeb

This investment is now sitting on big losses. It has been rolled into EUtelsat as a UK minority holding, only for those shares to fall more. It is difficult to see why the UK taxpayer should be losing money in a 10% holding of a European business like this that it is not currently making us money.

Sizewell C

Much delayed and significantly over its original budget.

The government should get rid of this body and go back to more detailed supervision by ministers advised by their departmental officials who currently help supervise these businesses. This track record is very poor and is not worth £24m a year.

- The Rt Hon Sir John Redwood, MP for Wokingham, Fri 23 Feb 2024

To give readers some idea of the culture at UKGI

Below is part of the summary of the last annual report from UKGI. It gives some idea of their priorities, while the British people’s money is being wasted on a grand scale.

“We successfully delivered our People Action Plan. Excellent progress was made against the key themes of connectivity, reward/recognition, work-life balance, hybrid working, leadership and culture. We have exceeded our formal gender diversity target with 46% of senior management now female and met our target to have 10% of the senior management cadre identifying from an ethnically diverse background. UKGI’s mean gender pay gap composition over the past five years has gradually shifted from 27.2% at 31 March 2018 to 6.6% as at 31 March 2023 and this underlines our commitment to furthering diversity and inclusion.”

- Latest UKGI annual report, 19 July 2023

Coming up in Part II

In Part II of this report we present readers with the full panoply of their investments - all of which are at risk. Do not miss this!

Observations

In our experience, when a conviction politician speaks out, the public are more inclined to listen. They recognise when an MP is not doing something for personal advantage or advancement. Sir John Redwood is in this category.

In his article he has drawn our attention to the way the UKGI is managing billions of pounds of losses to the British taxpayer and we are paying this quango £24m per annum for the privilege of doing so.

As Sir John points out, the UKGI’s stewardship of public funds has done nothing to prevent the scandal of the way sub-postmasters were treated, nor has it made any impact at NatWest, with all its woke policies and the debanking scandal there.

Despite this, here is what UKGI had to say yesterday

“Over the year, UKGI’s Corporate Governance and Portfolio Management Programme has continued to embed stewardship best practice across our evolving Portfolio of Assets. Our position as a centre of excellence means we seek continuous improvement in how we deliver this shareholder role, applying learnings across our portfolio.”

- UKGI Stewardship Code Report, 22 February 2024, (Vindi Banga, Chairman)

We would strongly question the “centre of excellence” status which the UKGI has conferred upon itself.

In Part II : What organisations are we funding? You don't want to miss this!

We must get reports like this out there

Reports like the one above take far longer to research, write and produce than many people realise. If they were easy, readers would see other organisations also producing these daily. However, there’s little point in the Facts4EU.Org team working long hours, seven days-a-week, if we lack the resources to promote them effectively – to the public, to MPs, and to the media. This is where you come in, dear reader.

Facts4EU.Org needs you today

We are a 'not for profit' team (we make a loss) and any payment goes towards the actual work, not plush London offices, lunch or taxi expenses, or other luxuries of some organisations.

We badly need more of our thousands of readers to become members, to support this work. Could this be you, today? It's quick and easy, we give you a choice of two highly secure payment providers, and we do NOT ask you for further support if you pay once. We just hope you keep supporting us. Your membership stays anonymous unless you tell us otherwise.

Please don't assume that other people will keep us going - we don't receive enough to survive and we need your help today. Could you help us? We rely 100% on public contributions from readers like you.

If you believe in a fully-free, independent, and sovereign United Kingdom, please join now by clicking on one of the links below or you can use our Support page here. You will receive a personal, friendly ‘thank you’ from a member of our team within 48 hours. Thank you.

[ Sources: UKGI | The Rt Hon Sir John Redwood MP ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Fri 23 Feb 2024

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget actually to post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments