Revealed : Terrifying bank practices live on after CEO’s departure

In February, NatWest CEO announced the de-financing of two entire, vital UK industries

Individual image credits - Natwest image: Emily Alexandra, CC0, via Wikimedia Commons, Dame Alison Rose Image: NatWestGroup Twitter, Coutts Bank image: TheOtherKev, Montage © Facts4EU.Org 2023

The CEO’s departure has not changed the bank’s threat to our electricity supply

Without its oil and gas industries the UK’s lights would go out for much of the time. Despite this, in February the former NatWest CEO announced the bank was blocking all new financing for oil and gas exploration, extraction and production - with immediate effect. This decision – clearly political - remains in place and her departure has changed nothing.

In today’s report Facts4EU.Org publishes an exposé of NatWest’s policies under Dame Alison Rose. We explain what is at stake when banks like the NatWest Group decide policies they think are good for us and exclude industries which “don’t align with our values”.

This affects every single one of us who use electricity.

Nigel Farage’s experiences were bad enough – but they are just the tip of the iceberg

In the last few weeks Nigel Farage’s experiences with the NatWest Group have quite rightly made the headlines. Yesterday he launched his new 'Account Closed' website to take up this cause.

Government stepped in – as a major shareholder in this bank we all bailed out – and the CEO was forced to step down. However, her policies live on. And these are policies which must clearly have been approved by the Board.

In what follows, we have summarised some very disturbing facts about the NatWest Group’s move to become a political organisation rather than a banking and financial services group.

Brexit Facts4EU.Org Summary

What WAS this woman thinking?

Speech by NatWest Group CEO, Dame Alison Rose, 09 Feb 2023

“Having climate change at the heart of our purpose-led strategy has changed the way we operate as a bank.”

“Almost 3 years ago, in this very building I announced that tackling climate change would be a central pillar of my strategy as CEO of NatWest Group. Today, a week ahead of the publication of our initial Climate Transition Plan, I want to take stock, outline our progress and set out our plans to drive further action.”

“I want to send a very clear message at the beginning of 2023 that we are not letting up on tackling climate change.”

“Having climate change at the heart of our purpose-led strategy has changed the way we operate as a bank.”

“So from today, we will not provide reserve based lending specifically for the purpose of financing oil and gas exploration, extraction and production for new customers, and, after, the 31st December 2025 we will not renew, refinance or extend existing reserve based lending specifically for the purpose of financing oil and gas exploration, extraction and production.”

- Alison Rose CBE, former CEO, NatWest Group, 09 Feb 2023

Almost unbelievable – and we comment on this in our ‘Observations’ below.

‘The political bank’ and its policies threaten two key industries and our electricity supply

Dame Alison Rose’s actions against Nigel Farage were bad enough. Now we can reveal that under her direct leadership – and with the agreement of the NatWest Board which continues to support her after her departure – she decided to stop lending to the entire UK oil and gas sector.

She announced in a speech on 09 February this year (2023) that NatWest was no longer interested in clients from the oil and gas sector.

Oil and gas represent a fundamentally important sector of the UK ecomony. Without them, and the myriad of companies which rely on them, the UK economy would suffer and we could all end up with the lights going out. Did Dame Alison forget she was a banker, not a politician or eco-warrior?

We still need to raise funding for the editing of our 'The Independence Documentary'

Together with our partners at CIBUK.Org, we've organised a TV-style documentary with a stellar line-up of well-known politicians and all kinds of interesting people, young and old, men and women, white and ethnic origin, presented by Alexandra Phillips.

Alex will be known to many readers as an ex-GB News presenter and a frequent sight on everything from Question Time to Talk TV.

We have finished filming - now we have the long task of editing by our professional production team, if we can get some extra funding. This is going to be big!

Please help today if you can: click here to read more

The UK still relies heavily on oil and gas – without it we would all grind to a halt

Some politicians may continually talk about green policies, but the majority of us still have to fill up our cars with petrol or diesel. The big tanker ships which bring massive imports to our shores – including Liquified Natural Gas – all need diesel fuel. Lorries need diesel to transport our goods by road.

The UK used to have a thriving offshore industry in oil and gas exploration and production. It seems that the NatWest Group wants to cut it off from all financing.

This is interesting in the light of the news that in the coming week Rishi Sunak is apparently due to announce a round of new licenses for North Sea oil and gas exploration. If British banks have gone woke, then we assume overseas investors will benefit.

“Who powers you, Baby?”

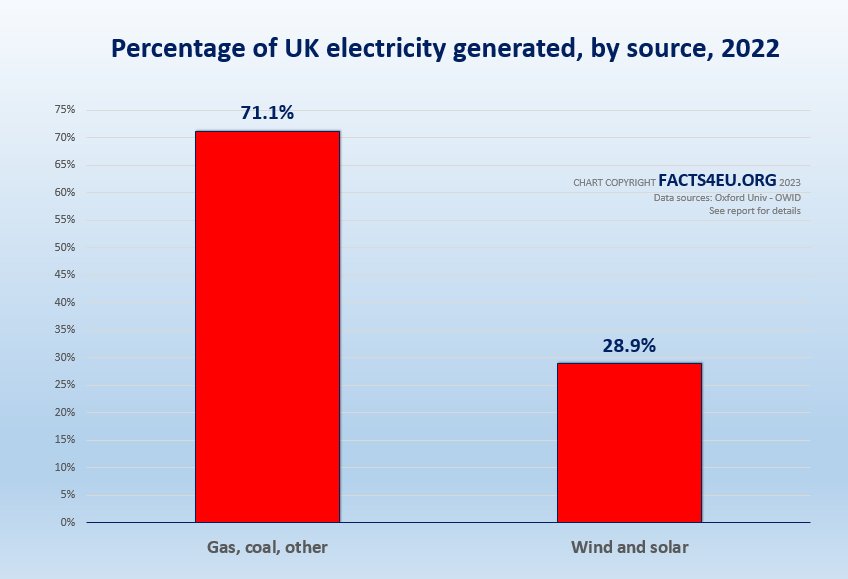

Below we show what powers the UK’s electricity production. Without this mix, the lights would go out in NatWest’s headquarters and all the computers would go down. The Board of the NatWest Group would not even be able to ascend in a lift to their luxury floor.

Brexit Facts4EU.Org Summary

Where does NatWest’s electricity come from?

As always, Facts4EU.Org went to the most definitive sources to find out how the UK’s electricity is generated. Below we show the percentages of each source, for the NatWest Board’s benefit.

- Gas, coal, oil, other : 71.1%

- Solar and wind : 28.9%

[Source: Oxford University’s ‘Our World in Data’.]

© Brexit Facts4EU.Org 2023 - click to enlarge

Maybe energy companies should stop supplying electricity to the banks?

If NatWest can close an account that ”doesn’t align with our purpose and values”, then why don’t energy companies follow suit and stop providing electricity to the banks, which have very different “purposes and values” to them?

If Dame Alison Rose is so keen on Net Zero – can someone please turn off the electricity to her laptop?

It gets worse – “A Rose by any other name”

Unfortunately Rose and her banking colleagues are not alone. It turns out that many insurance companies have embarked on the same woke, ESG/EDI agenda.

Underwriting the threat to our electricity supply, two years ago the United Nations came up with something called the “Net Zero Insurance Alliance” (NZIA). This demands that by 2050 member firms must cut off all customers in industries which emit greenhouse gases.

Given that insurance companies, like banks, have provided finance to the oil and gas sector and that this is now actively being discouraged, what chance does the energy sector have?

It seems highly likely that not only will individuals and companies be increasingly de-banked, they will also be de-insured. In the case of the oil and gas sector this means it will become unviable. Amongst other things, here is what the UN requires insurers to sign up to:-

“My company commits to:

“Transitioning all operational and attributable greenhouse gas (GHG) emissions from its insurance and reinsurance underwriting portfolios to net-zero emissions by 2050.”

“Establishing, to the extent permissible by applicable laws and regulations, its intermediate, science-based targets every five (5) years in line with Article 4.9 of the Paris Agreement.”

In other words this has already started and will accelerate every six months. Here is some more from the UN’s “Statement of commitment by signatory companies” :-

“My company will:

“Seek to meet this Commitment through net-zero approaches relevant to insurance and reinsurance underwriting portfolios, in such a manner that is at the discretion of my company and in accordance with applicable laws and regulations, including but not limited to:

“Setting independently underwriting criteria and guidelines for activities where my company has, or can have, the most significant impact, particularly the most GHG-intensive and GHG-emitting activities within its underwriting portfolios, in order to be aligned with a 1.5°C net-zero transition pathway.”

UN “Net Zero Insurance Alliance” (NZIA), 05 July 2023

The failed bank in which you own a 42% share

The NatWest Group used to be known as RBS – The Royal Bank of Scotland. Following the banking collapse in 2007/2008 it had to be bailed out by the taxpayer. Even today it is 42% owned by the public, according to a Government statement on 03 April of this year.

When Dame Alison Rose took over as CEO of NatWest, she appears to have decided that a ‘woke agenda’ was the most important aspect of her leadership, in returning funds to the British taxpayer.

Observations

Why did the NatWest Board go along with the bank becoming a climate campaigner?

Oil and gas represent a fundamentally important sector of the UK economy. Without them, and the myriad of companies which rely on them, the UK economy would suffer and we could all end up with the lights going out. Did Dame Alison forget she was a banker, not a politician or climate protester?

Did you know about the NatWest Group’s policy under CEO Dame Alison Rose to de-finance the UK’s oil and gas industries? Did you know about the United Nations’ insurance sector plan to un-insure customers who don’t meet its climate change agenda?

Today we are publicising this outrageous intrusion by banks and insurance companies into an area of politics. Early this month – well before Nigel Farage started getting the support of the mainstream parties - we wrote about the descent of the corporate world into wokery, instead of focusing on their day job – which should be that of delivering for their customers and shareholders.

The peasants are revolting

Those who inhabit the top floors of corporate Britain must wake up and smell their double latte cappuccinos. They are now completely out of touch with the majority of their customers.

It is becoming increasingly clear that legislation is required to prevent businesses – be they banks, insurance companies, or anyone else – from discriminating against customers on the grounds of political opinions or their legitimate business interests.

On a more general level we all need to speak up and tell these people in the big corporates that we expect them to focus on what they are there to do. If they want to espouse political views, there is a place called Parliament in which to do that. They just have to get elected by the people first.

We must get reports like this out there

Reports like the one above take far longer to research, write and produce than many people realise. If they were easy, readers would see other organisations also producing these daily. However, there’s little point in the Facts4EU.Org team working long hours, seven days-a-week, if we lack the resources to promote them effectively – to the public, to MPs, and to the media. This is where you come in, dear reader.

Facts4EU.Org needs you today

We are a 'not for profit' team (we make a loss) and any payment goes towards the actual work, not plush London offices, lunch or taxi expenses, or other luxuries of some organisations.

We badly need more of our thousands of readers to become members, to support this work. Could this be you, today? It's quick and easy, we give you a choice of two highly secure payment providers, and we do NOT ask you for further support if you pay once. We just hope you keep supporting us. Your membership stays anonymous unless you tell us otherwise.

Please don't assume that other people will keep us going - we don't receive enough to survive and we need your help today. Could you help us? We rely 100% on public contributions from readers like you.

If you believe in a fully-free, independent, and sovereign United Kingdom, please join now by clicking on one of the links below or you can use our Support page here. You will receive a personal, friendly ‘thank you’ from a member of our team within 24 hours. Thank you.

[ Sources: Oxford University - Our World in Data | NatWest Group | United Nations - NZIA ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Sun 30 Jul 2023

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget to actually post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments