Hunt’s tax on growth plunges the UK down Europe’s competitiveness table

Dropping from 4th= to 10th= the Chancellor’s bizarre decision is panned by all

Montage © Facts4EU.Org 2023

Higher taxes for business will result in lower growth and lower business tax revenues

All budgets contain a great many measures affecting all the economic activities of the country. The budget of the Chancellor of the Exchequer Jeremy Hunt yesterday was no exception. Today we focus on just one measure which is key for the success of Brexit Britain: the headline rate of tax on business.

‘Corporation tax’ makes everyone think of large companies. In reality this is a tax on the profits of every business in the country, from a small furniture maker employing six people in the West Country to a global pharmaceutical company headquartered in London.

Brexit Facts4EU.Org Summary

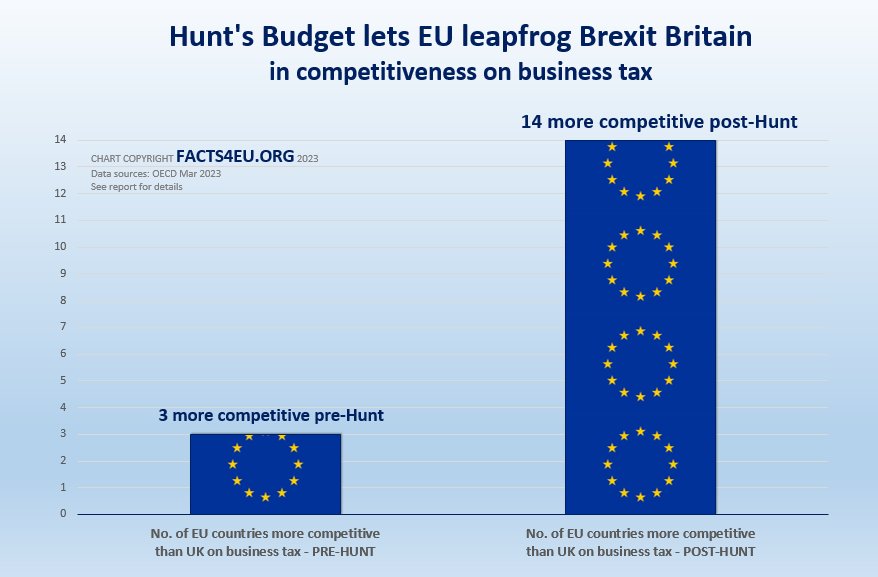

Brexit Britain's falling competitiveness under Chancellor Hunt

- Hunt’s business tax rate will now make the UK less attractive than Lithuania, Poland, Latvia or Greece

- It puts the UK on a par with Belgium, home to the EU’s institutions

- Brexit Britain was previously 4th equal when placed in the EU league table

- After yesterday’s budget, Brexit Britain will plummet to 10th equal

- Right now, only three EU countries have a more attractive business tax rate than the UK

- From 6th April only five EU countries will be less attractive than the UK

[Source: OECD tables accessed 16 Mar 2023.]

(Note: Not all EU countries are large enough to appear in the OECD's figures.)

© Brexit Facts4EU.Org 2023 - click to enlarge

![]()

The UK’s Rejoiners and ‘Globalists’ have received over £3m in foreign funding

We’re trying to raise just £100,000 p.a. – Can you help with a donation?

Please help today if you can: click here for options

![]()

What has the Chancellor done?

Following the decision of Mr Hunt yesterday the rate of corporation (business) tax in the UK will now rise from its current level of 19% to 25%. This represents nearly a 30% increase in the tax which businesses will have to pay on their profits.

Not only will this result in companies choosing to invest in countries where the tax rate is lower, it will also result in a lower amount of tax revenues for the Treasury. Whilst this sounds counter-intuitive it is not. The evidence shows that (up to a certain level) an increased tax rate actually reduces the amount of money a government receives. This has been proven many times around the world and the evidence is compelling.

It applies to business and personal taxes and readers may wish to review a report which Brexit Facts4EU.Org published last year, which explains the phenomenon in more detail.

Observations

This matters if readers and their loved ones want continued high employment in Brexit Britain

As regular readers will know, Brexit Britain has defied all the so-called ‘experts’ and has an unemployment rate far lower than that of the EU average. The massive job losses threatened by David Cameron, George Osborne, and HM Treasury if we voted to leave the EU not only failed to materialise, they actually turned into a massive increase in jobs.

Not one head has rolled at the Treasury as a result of this, nor has there ever been an apology for misleading the public in such a grotesque way.

Now we have the Remain-voting Chancellor – who vowed to halve business tax rates when he stood as a candidate to take over from Liz Truss as PM last year – deciding to increase business tax only a few months later. All the evidence shows that this is the last thing the country needs as it faces very uncertain economic times, given the troubling developments in Europe and around the world.

Case study

Facts4EU knows of one SME business – currently based in the UK and selling globally – which is considering a major investment for them. This company can be based anywhere. The owners tell us that they are now exploring the possibility of relocating to Ireland, where the business tax rate is half that in the new Chancellor’s United Kingdom.

25% of the tax on the extra profits the Company could generate from this investment will be lost to the Treasury if this business relocates. In addition, all of the existing tax revenues currently being received by the Treasury will also disappear.

19% of something is something. 25% of nothing is nothing.

We must get reports like this out there

Reports like the one above take far longer to research, write and produce than many people realise. If they were easy, readers would see other organisations also producing these daily.

However, there’s little point in the Facts4EU.Org team working long hours, seven days-a-week, if we lack the resources to promote them effectively – to the public, to MPs, and to the media. This is where you come in, dear reader.

Facts4EU.Org needs you today

We are a 'not for profit' team (we make a loss) and any payment goes towards the actual work, not plush London offices, lunch or taxi expenses, or other luxuries of some organisations.

We badly need more of our thousands of readers to become members, to support this work. Could this be you, today? It's quick and easy, we give you a choice of two highly secure payment providers, and we do NOT ask you for further support if you pay once. We just hope you keep supporting us. Your membership stays anonymous unless you tell us otherwise.

Please don't assume that other people will keep us going - we don't receive enough to survive and we need your help today. Could you help us? We rely 100% on public contributions from readers like you.

If you believe in a fully-free, independent, and sovereign United Kingdom, please join now by clicking on one of the links below or you can use our Support page here. You will receive a personal, friendly ‘thank you’ from a member of our team within 24 hours. Thank you.

[ Sources: Chancellor's statement 15 Mar 2023 | OECD tax rates tables ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Thurs 16 Mar 2023

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget to actually post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments