Liz’s tax cuts – a simple guide to why lowering rates actually works

Proof from the UK and around the globe that lower tax rates encourage growth

Montage © Facts4EU.Org

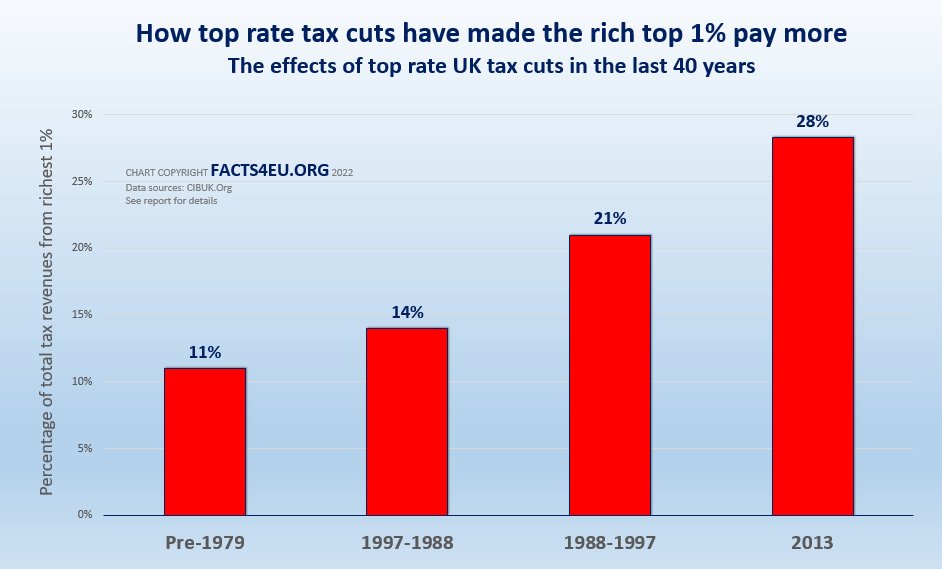

Lowering top rates of tax also produces a greater tax-take from the rich

With western economies engulfed in a perfect storm of escalating debt, rising inflation and sluggish growth, we look at the controversial issue of Liz Truss’ tax cut strategy and reveal the facts of how it has been proven to work - many times over.

Not only have tax cuts stimulated growth, they have also resulted in the rich paying a higher share of tax revenues, not lower. Below we cite examples from the UK and around the world.

The following has been adapted from a longer article by CIBUK.org which draws on the work of other organisations.

The Facts4EU.Org layman’s guide to a low tax, high growth economy

For policy makers in the UK the evidence is compelling. Tax cuts increase revenue and the highest payers pay a higher percentage of the total take.

Brexit Facts4EU.Org Summary

Delivering a low tax, high growth economy

1. Evidence from the United Kingdom that tax cuts work

1979 - 1988 : Chancellor Geoffrey Howe cut the top rate from 83% to 60%. Before the cut, the top 1% of UK taxpayers paid only 11% of the total income tax take. By 1988 they were paying 14% of income tax revenue.

1988 - 1997 : Nigel Lawson cut top rates from 60% to 40% and receipts rose further. By 1997 the top 1% of earners paid a huge 21% of the total tax bill.

2013 : Chancellor Osborne cut the additional rate of income from 50% to 45%. In the subsequent year £8bn more revenue was raised. The top 1% of taxpayers now pay 30% of income tax.

© Brexit Facts4EU.Org 2022 - click to enlarge

When adding in National Insurance contributions - which we should as they are effectively an additional tax on income - the top 1% were paying 34% of the the total income tax reveneue of the UK government by 2018. More than one-third of the total tax-take.

2. Evidence from the United States

1921 - 1951 : The top rate of US income tax was raised to 71% during WWI with dire economic results and was later cut to 25% by Presidents Coolidge and Harding. As a result, revenues nearly doubled. The share of tax paid by those earning over $100k rose from 28% in 1921 to 51% in 1925.

1963 – 1968 : President Kennedy's 1963 tax cuts reduced taxes at all levels, cutting the top rate from 91% to 70%. Total income tax revenue increased from $68.8 bn in 1964 to $95.7 bn in 1968. The share of tax paid by those earning over $50k went up from 12% in 1963 to 15% in 1966.

1981 – 1986 : President Reagan cut the top rate of US income tax from 70% to 50% in 1981 and cut the top rate again to 28% in 1986. The share paid by the top 10% of taxpayers increased from 48.0% in 1981 to 57.2% in 1988.

The opposite is also true.

1990 – 1991 : President George HW Bush raised the top marginal income tax rate to 31% in 1990. Tax receipts fell as a % of GDP and in 1991 after the tax increase richer taxpayers paid $6.5 billion LESS than they had in 1990.

2003 – 2007 : These were later reversed by his son George W. Bush. In 2003 he reduced the highest rate of income tax from 39.6% to 35% and the dividend tax from 39.6% to 15%. From 2004 to 2007 federal tax receipts increased by $785 billion with the bulk of that coming from the better off.

3. Evidence from around the world

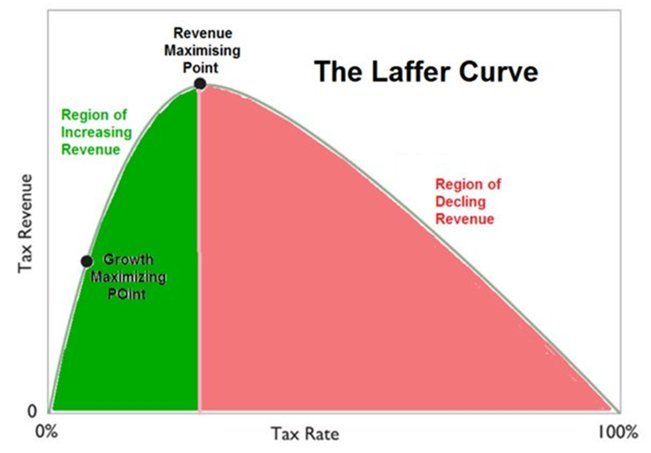

Below are just a few extra examples from across the globe, proving that the ‘Laffer Curve’ works.

Canada 1981 – 1992 : When the top federal tax rate in Canada was cut from 45% in 1981 to 29% in 1990, the share of tax receipts paid by the top 10% of taxpayers grew from 29% in 1981 to 45% in 1992.

India 1984 – 1985 : India in 1984 reduced its top income rate from 65% to 50%. As a result, tax revenue in the 1985 fiscal year rose by 20% over 1984.

Sweden 2016 : Sweden increased income tax for high-earners by 3% to 60% in 2016. The affected group reduced their earnings and less revenue was raised.

Care to know the history behind the 'Laffer Curve'?

It’s worth recalling the now famous dinner which took place at the Two Continents Restaurant in Washington in December 1974 at which the US economist Arthur Laffer drew his famous curve on a napkin to illustrate the economic phenomenon which now bears his name.

© Arthur Laffer - click to enlarge

His thesis was the trade-off between tax rates and tax revenues - something of major importance in the UK right now. Put simply, it challenges the assumption that if tax rates are lowered, revenues will be lowered by the amount of the decrease in the rate. According to Laffer, the reverse is true.

US economist Arthur Laffer

“The economic effect recognizes the positive impact that lower tax rates have on work, output, and employment - and thereby the tax base - by providing incentives to increase these activities.

“Raising tax rates has the opposite and negative economic effect by penalizing participation in the taxed activities. The arithmetic effect always works in the opposite direction from the economic effect.”

Observations

Lower taxes and higher growth

This is perhaps stating the obvious but it needs saying.

We have demonstrated above that when tax rates go down, tax revenues tend to increase. Most people pay tax on their earned income and businesses pay taxes on their profits. It follows that tax revenues can only increase when tax rates go down because people are earning more, and businesses are making more profits. Ergo the economy is growing.

Tax cuts create an incentive to increase output, employment, and production, so they also help balance the budget by reducing means-tested government expenditures. A faster-growing economy means lower unemployment and higher incomes, resulting in reduced unemployment benefits and other social welfare programs.

Finally, ‘levelling up’ and equity. When top-rate taxes are reduced, the top earners end up paying a higher proportion of the total tax take.

We really hope that more MPs will want to consider the facts before conspiring against the Government’s policies based on little knowledge.

This is basic economics – it’s not party political

Facts4EU.Org remains non-partisan, We simply wish to see a fully-free, fully-independent, and fully sovereign United Kingdom be as successful as possible on the world stage.

Facts4EU.Org needs you today

We are a 'not for profit' team (we make a loss) and any payment goes towards the actual work, not plush London offices, lunch or taxi expenses, or other luxuries of some organisations.

We badly need more of our thousands of readers to become members, to support this work. Could this be you, today? Maybe you've been thinking about it, but just haven't got around to doing it? If so, let us reassure you. It's quick and easy and we use two highly secure payment providers. And we do NOT ask you for further support if you pay once - we just hope that you keep supporting us. Your membership stays anonymous unless you tell us otherwise.

Please don't assume that other people will keep us going - we don't receive enough to survive and we need your help today. Could you help us?

Most of our readers are well-informed and appreciate our fact-based articles, presented in a way you won't see anywhere else. We have far more to do in researching, publishing, campaigning and lobbying Parliament than we have in terms of the financial resources to fulfil these tasks. We badly need funding to continue - we rely 100% on public contributions from readers like you.

If you believe in a fully-free, independent, and sovereign United Kingdom, please join now. It’s quick, secure, and confidential, and you can use one of the links below or you can use our Support page here. You will receive a personal, friendly ‘thank you’ from a member of our team within 24 hours. Thank you for reading this.

[ Sources: CIBUK.Org | House of Commons Library | ONS | HMRC ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Thurs 13 Oct 2022

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget to actually post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments