EXCLUSIVE: Bank of England's bond trading has cost us all £100 BILLION in last 3 years, 2023-2025

This is set to rise to an astronomical £288 BILLION. “That’s a lot of black holes, Rachel,” says Lord Redwood

Montage © Facts4EU.Org 2026

Facts4EU's bombshell report reveals biggest economic scandal this century

“Bombshell” can be an overused word, but not in this case. The scandal we are revealing today has already – and needlessly – cost the country almost £100 billion in the last three years, 2023-2025. This is NOT a misprint. £100 billion. That’s an average of £33.3 billion per year for the last three years.

In all the political turmoil over Peter Mandelson, Andrew Mountbatten-Windsor, and the future of Sir Keir Starmer, this huge scandal has been rumbling on almost unnoticed by the media.

If no action is taken – and none is planned by Sir Keir Starmer – over the next 10 years the OBR forecasts this action by the Bank of England will cost the country a total of £288 billion.

Running at £20 billion per year, that’s an awful lot of Rachel Reeves’ “black holes”.

The Facts4EU.Org team once again publishes another unique, bombshell report in collaboration with Stand for Our Sovereignty and in association with GB News. This shocking information is being brought to the public for the first time.

Elements of this story have of course been discussed by economists, but as far as we are aware this is the first time this story has been summarised in this way for the general public. In the light of its importance, we have been pleased to share it with GB News.

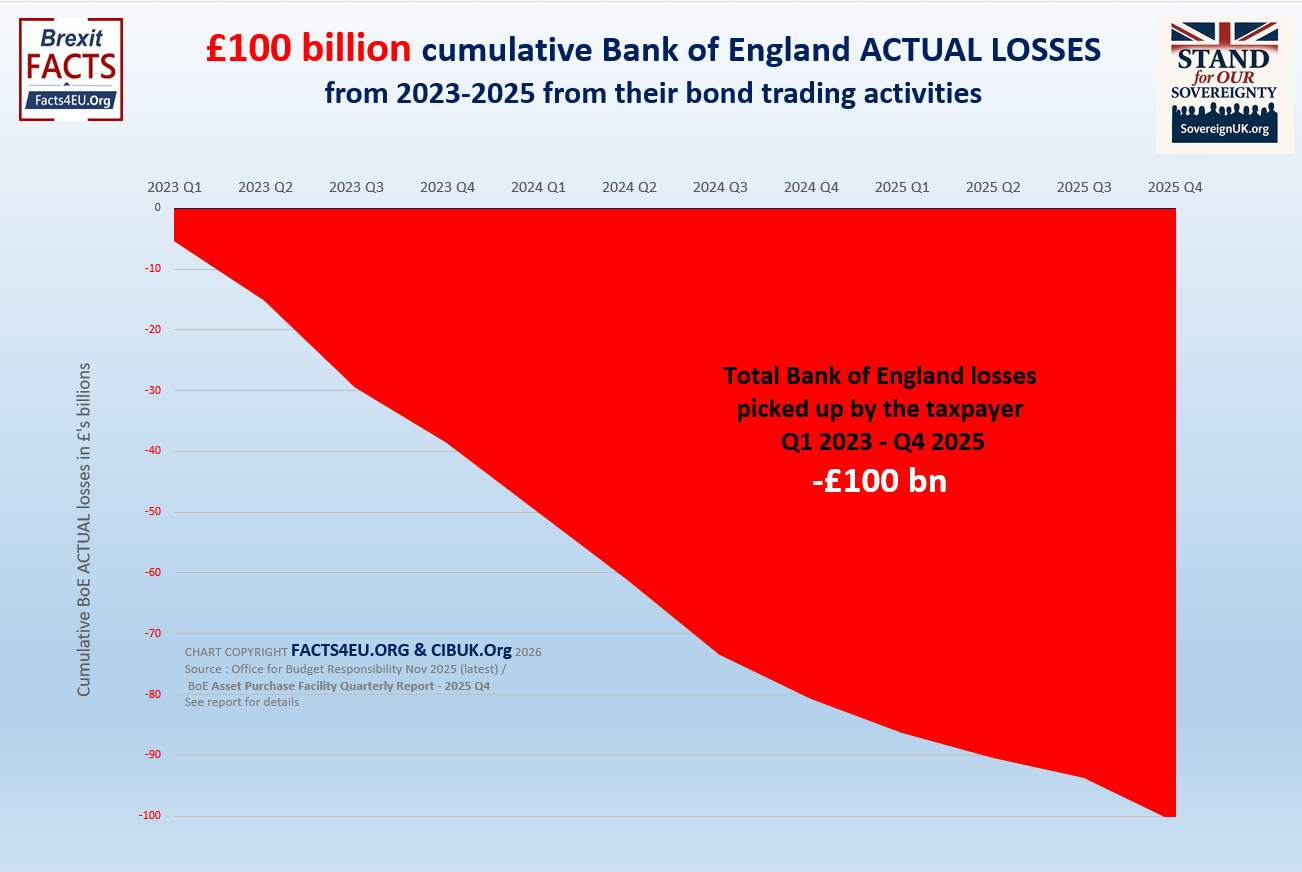

The story starts with the most recent losses, in the three years from 2023-2025

The Bank has managed to lose £100 BILLION in the last 3 years alone

© Brexit Facts4EU.Org 2026 - click to enlarge

[Source(s) : OBR | BoE]

As all of the Bank’s “Asset Purchase Facility” is fully underwritten by HM Treasury, so the poor old taxpayer was forced to take the hit. There is nothing that can be done here - the damage is done. The chart above demonstrates very dramatically what has happened since the Bank started losing money, at the end of 2022.

£100 billion has been lost in the last three years.

How the Bank of England lost this money

We have deliberately simplified this report to be understood by everyone. Something this big should not be confined to economists to argue over. Going forward, we will generally refer to “the Bank”, meaning the Bank of England on Threadneedle Street in London.

Credit: Acediscovery, BoE

A Facts4EU brief explainer

1. The Bank buys too many bonds at over-inflated prices

2. Separately it puts up interest rates to control the inflation it has created

3. The prices of bonds crash

4. The Bank starts selling its bonds at huge losses and sends the bill to the taxpayers, via HM Treasury

And is this confined to the UK?

In short, yes. Both the US Federal Reserve (“the Fed”) and the EU’s European Central Bank (“the ECB”) also misjudged their bonds, but neither institution has been selling at a loss like the Bank of England.

As ever, Lord Redwood sums up the situation in its grim detail

“Yes, the story here is the huge losses. The Bank bought too many bonds at over-the-top prices, paying more for them than they will get back when they repay.

“They then increase the losses by dumping them in the market at even larger losses which no other Central Bank is doing.

“They pay the commercial banks who lend them the money to buy the bonds more in interest than they get on the bonds.”

- Lord Redwood, 19 Feb 2026

£100 billion in 3 years is horrendous – but what’s coming down the road?

The figures on which both charts in this report are based are taken directly from the information given by the Office for Budget Responsibility (OBR) to the Chancellor, Rachel Reeves, when she was formulating her November budget. She is obliged to rely on their forecasts.

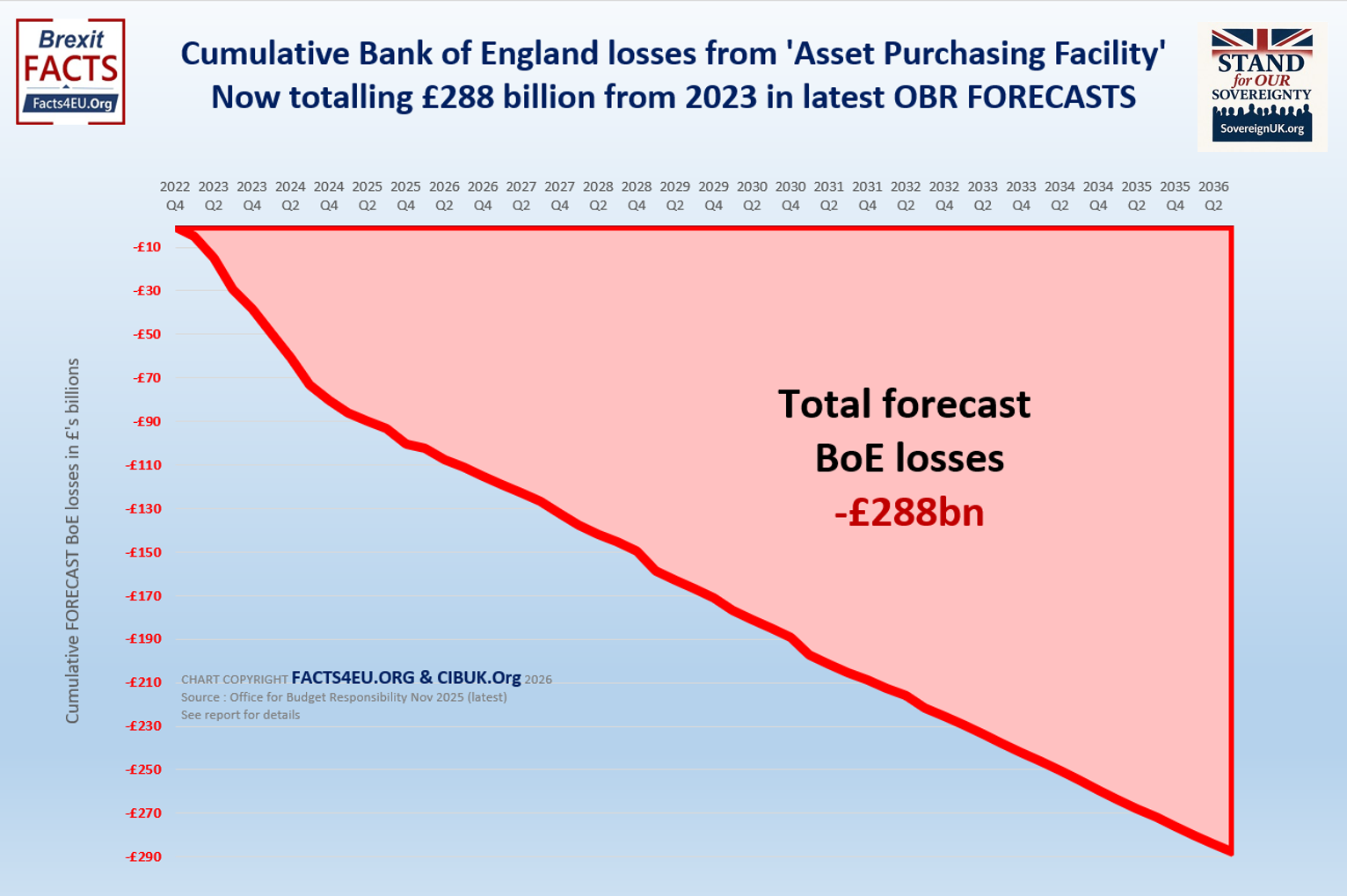

The chart below shows the Bank is forecast by the OBR to lose EVEN MORE taxpayer money

The OBR forecasts the Bank’s cumulative losses to amount to £288bn 10 years from now

This runs from the start of when the Bank became unprofitable in Q4 2022

A debate is currently raging on the value of the OBR as a body, and of the role it plays in determining the Chancellor’s decision-making when it comes to her Spring and Autumn statements.

That is a subject for another day, however. For the moment we are showing what the Chancellor looks at from the OBR, in terms of the Bank’s projected losses over the remainder of this Parliament, and beyond.

© Brexit Facts4EU.Org 2026 - click to enlarge

[Source(s) : ]

If this is about bonds, what is a bond?

A government bond is commonly referred to as “a gilt” but we will simply use the most common expression, a bond. The government borrows from investors, so a bond is a form of loan.

The government promises to pay interest on the bond and to repay the bond on a specified date. If the investor does not want to wait for repayment, they can sell their bonds (their part of the government’s overall loan) to someone else at the market price. This is usually less than the money they would get back if they held onto it until its ‘maturity date’, when they get repayment.

In effect, the Bank bought up a lot of state debt when they had to pay considerably more than the original loan value as a result - counter-intuitively - of low interest rates. This is how one loss was created. They then increased the losses by dumping them in the market at even larger losses. This is something neither the Fed or the ECB is doing.

The third part of the loss is paying the commercial banks who lend them the money to buy the bonds more in interest than they get on the bonds.

Summarising the three ways the Bank is losing money

- Holding their bonds to maturity (repayment date) and getting less back than purchase price

- Selling bonds now and losing much more money on them. Holding them for longer could reduce losses significantly

- The Bank pays the commercial banks more in interest than the interest the state pays them on the bonds.

Here is Lord Redwood again, with his thoughts on this

(Credit: Parliament TV)

“At a time when the UK state is borrowing and spending too much the last thing we need are large losses from The Bank of England.

“The Bank should be embarrassed by being one of the world's worst bond traders, piling up losses for the Treasury to bail out.

“Buying the bonds was a joint decision of Bank and Treasury, with taxpayers granting a guarantee against loss.

“The Chancellor should pick up the phone, tell the Governor the bills he sends her are too large and ask him to cut them.”

- Lord Redwood, xx Feb 2026

So what can and should be done?

- For obvious reasons there is nothing the Bank can do about No.1 above

- Selling bonds early seems very ill-advised and should be stopped

- The Bank could simply pay the commercial banks less interest, saving a great deal each year

A rare example of the EU working smarter

It is not often that we give an example of the EU working smarter than the UK, but the ECB has very sensibly decided to pay commercial banks less interest on their bonds. The Bank should simply follow the ECB’s example and thereby save a lot of taxpayer money.

Observations

Firstly, credit where it is due. We are grateful to Lord Redwood for his assistance with this report and for his comments.

Perhaps the most fundamental point arising out of this scandal is that Facts4EU has revealed it at a time when the ramifications of Rachel Reeves' first and second budgets are still being discussed. In particular there is the continuing row over her various tax rises at a time when she seems to find no problem in paying ever increasing amounts of benefit payments.

The sums involved above are truly of a sufficiently significant size as to impact what she could and could not do. Whilst it is very difficult to estimate the savings that could have been made - and that could yet be made - if the Bank followed different policies such as those of the Fed and the ECB, they would certainly be large enough to allow different policies from the Chancellor.

The policies we are thinking of are those which directly impact people's lives.

The question that lies hanging, unanswered at present, is what steps this Chancellor and her predecessor have taken towards the Bank. If ever "the public have a right to know", it is surely on a question such as this.

We invite readers to ask themselves who would be uncovering scandals such as this if Independence Facts4EU were no longer around. Please, please help us to carry on our vital work in defence of independence, sovereignty, democracy and freedom by donating today. Thank you.

[ Sources: Office for Budget Responsibility Nov 2025 report | Reports from Bank of England Jan 2026 ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Xxx xx Feb 2026

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget actually to post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down and be the first to comment