Why are we hearing about so many taxes that might rise in Rachel’s budget?

The GBN 'Pre-Budget Special' No.2

We present facts which debunk the excuses and show why she should cut costs instead

Montage © Facts4EU.Org 2025

Welcome to the second of our Pre-Budget Specials, in association with GB News

Part I : "The definitive, slam-dunk debunk of the Chancellor's false claims"

Part II (today) : "Why are households paying the public sector £45,000 per year - for a worse service, and higher taxes?"

PLUS Special Supplementary : Rachel’s 10 TRILLION pound secret - Where has this money gone?

And Part III coming next week!

This budget is turning out to be the most trailed budget in history. Hardly a day goes by without the Treasury briefing out (unattributively of course) some new tax rise that is being considered. On Tuesday we had a strange and very rare event, with the Chancellor giving a 19-minute speech as ‘a background’ to her actual budget speech in three weeks’ time.

In this second in the series of ‘GB News Pre-Budget Specials’, the Brexit Facts4EU and The Campaign for an Independent Britain (CIBUK) teams, together with the Rt Hon Sir John Redwood, unpick some of the rumours, claims, and accusations, and present the official facts instead.

“When Rachel Reeves gave her pre-Budget Budget speech she looked like a lonely hostage, made to say she will raise taxes by the socialists who had taken her prisoner. There was no word about spending reductions despite the obvious waste. There was no news on how she will recoup lost productivity, though the poor management of the public sector is ripping off taxpayers on an industrial scale. The money sink that is the HS 2 project, the huge losses of the Bank of England, the needless surrender of Chagos with a dowry for Mauritius are a few examples of needless spending.

“How on earth does she think the public will respond to a second higher-tax, economy-crushing budget?”

- The Rt Hon Sir John Redwood, 06 Nov 2025

The Chancellor has given a number of excuses for the tax rises which seem to be coming our way, and on Tuesday she talked about inflation and productivity. This Pre-Budget Special looks at both these issues, starting with inflation.

1. What has happened to inflation, and why? Does it explain Rachel’s threatened tax rises?

- Why has inflation nearly doubled since Rachel became Chancellor?

- Who or what is causing all the price rises since she moved into 11 Downing St?

- Using latest official figures we analyse why it costs so much to live in Rachel’s Britain

On Tuesday Ms Reeves said:

“Inflation is already much lower than the double digits seen under the previous government.”

- Chancellor of the Exchequer, Tues 04 Nov 2025

On her recent trip to Saudi Arabia, she also implied that the UK’s high inflation was somehow due to Brexit.

Unfortunately for the Chancellor, the facts tell a different story

The most obvious fact is that inflation has almost doubled under Rachel Reeves.

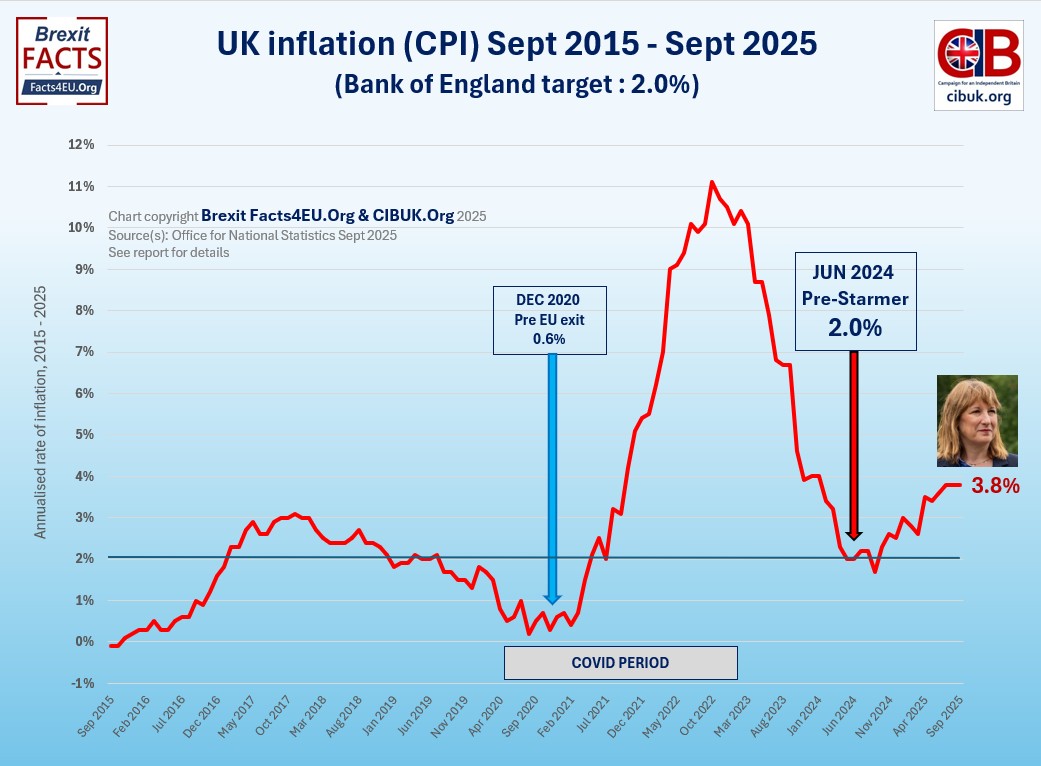

When she took up her role as Chancellor of the Exchequer last year, the rate of inflation (CPI) stood at 2.0%. This also happens to be the Bank of England’s target ceiling. Over a year later it stands at 3.8%, nearly double the target.

© Brexit Facts4EU.Org 2025 - click to enlarge

[Source(s) : Office for National Statistics, Nov 2025]

The chart above uses the official data from the UK’s Office for National Statistics. As the ONS does, we have used CPI as this is directly comparable with EU27 countries.

The chart shows:

- Inflation was already increasing in 2015, the year before the Referendum

- The existing upward trend continued until 2017

- When it was rising, it never reached the current level under Ms Reeves

- After 2017 it steadily fell, down to 0.6%

- It then rose steeply as Covid measures struck - see below

- Then after a peak of 11.1% it fell for 7 quarters running

- Ms Reeves inherited the desired rate of 2.0% in June 2024

- Currently (Sept 2025), the rate stands at 3.8%, far above the target

The body with part of the responsibility for managing inflation is the Bank of England. In November 2023 it published a 22-page paper, called ‘UK inflation since the pandemic: How did we get here and where are we going?’ It attributed the rise in inflation in 2021 to the effects of COVID and its lockdowns, causing global supply chain problems and other issues. Not once in its 22 pages did it state Brexit as being one of the causes. In fact, it only referred to the UK’s departure from the EU once, and that was in a footnote.

The facts

- Tax rises due to inflation cannot be pinned on Brexit

- Inflation has only reached its current high level since she became Chancellor

- If tax rises are due to inflation, then Ms Reeves might want to look at the inflationary effects of her own policies, including the large rise in N.I. contributions at the last budget.

“The near doubling of inflation so far under Rachel Reeves has nothing to do with Brexit and everything to do with her last budget and Mr Miliband's crazy energy policies.

“The government has put up National Insurance and business taxes, forcing business to increase prices to be able to pay their staff. It has put up the managed prices of energy when it promised lower bills. It has given large pay awards to the public sector without any productivity improvements to help pay for the extra costs. It is making it dearer to employ people, to buy and sell properties, to rent out a home, to run a small business and to manage a farm to grow food.

“The private sector is seen as a source of funds to pump-up public sector costs without delivering better service. No wonder prices go up in the shops with the government raiding all who produce and retail the goods we need.”

- The Rt Hon Sir John Redwood, 06 Nov 2025

2. Everyone is talking about tax rises, but if costs were cut we wouldn’t need tax rises

We have heard a lot about the possible taxes which might increase. What we have not heard about are any cost-saving measures, as possible ways of avoiding the ‘black hole’ in the nation’s finances.

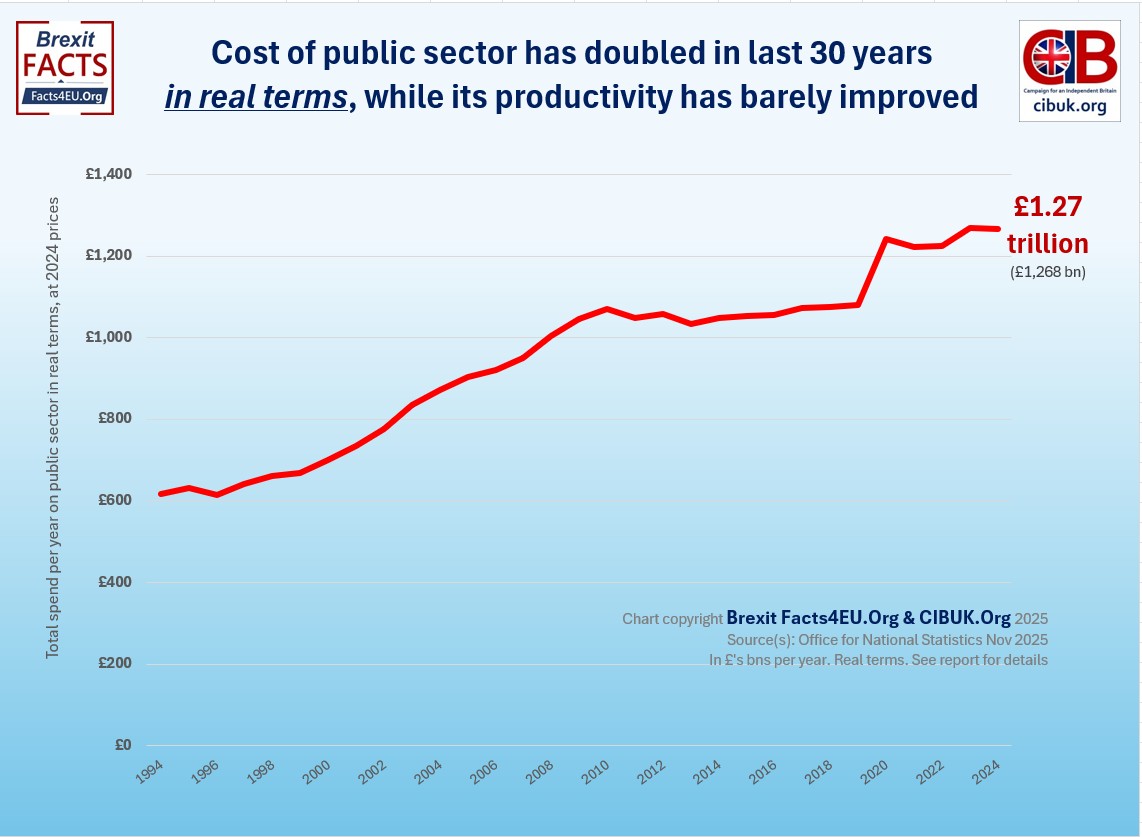

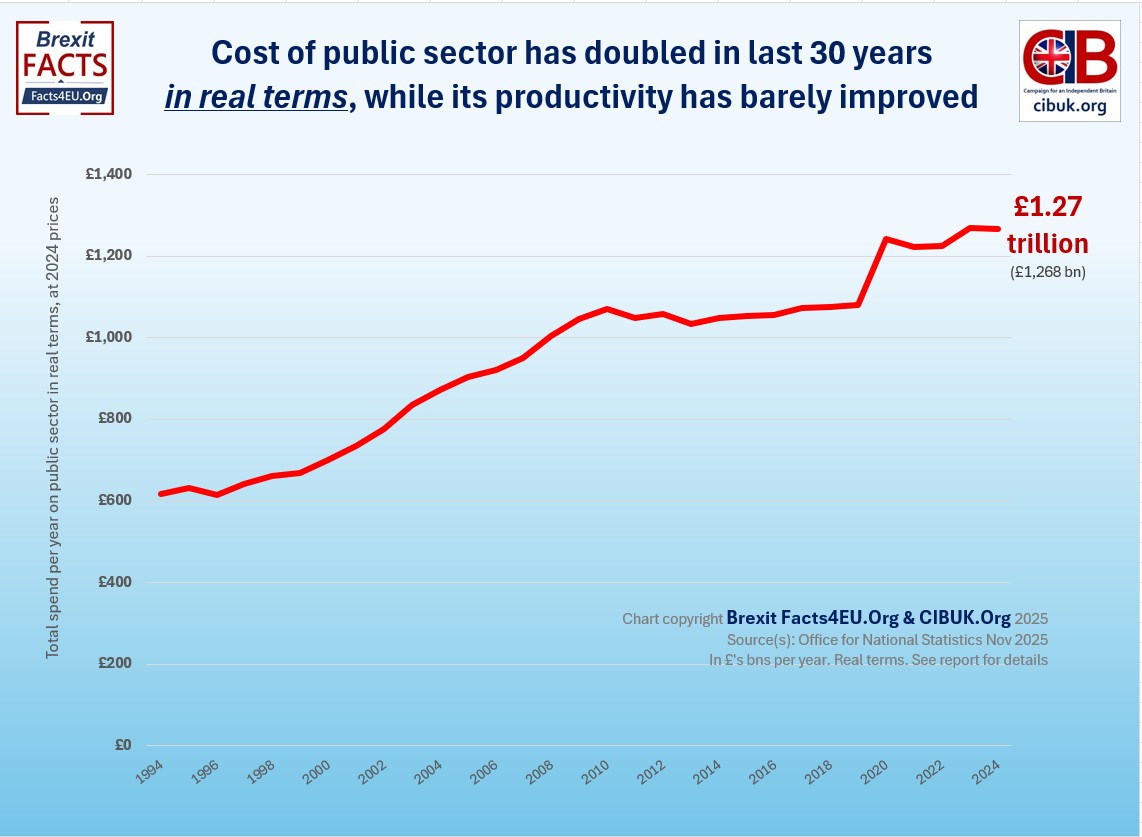

If Ms Reeves cut just 2.5% from public sector spending, that would save £33 billion per year. This, according to many of the rumours which abound, would cover her ‘black hole’. Below we show how public sector spending has risen, in real terms, in the last 30 years.

© Brexit Facts4EU.Org 2025 - click to enlarge

[Source(s) : Office for National Statistics, Nov 2025]

The average household is now paying the public sector £45,000 per year

According to the Office for Budget Responsibility:

“In 2024-25, we expect public spending to amount to £1,278.6 billion, which is equivalent to around £45,000 per household or 44.4 per cent of national income.”

So if you live in an average household, the public sector is costing you “around £45,000 per year”. Despite this seemingly enormous amount per household, representing a total of approximately £1.28 trillion pounds this year, we have yet to hear Ms Reeves talking about where major savings can be made. (Our figures from the ONS indicate £1.27 trillion, marginally less.)

“Cutting spending is the way to right the economy and create the stability the Chancellor claims but fails to deliver.

“A single phone call from her to the Governor of the Bank of England could save taxpayers more than £10 bn. Tell the Governor to stop selling bonds at a loss and sending the bill to taxpayers. The Chancellor has always had to sign off the decisions on the bonds.

“Take immediate measures to get productivity in the public sector back up to the levels of 6 years ago. That should be an easy £18bn a year win. Tell Mr Miliband his big schemes for renewables and carbon projects need to be financed in the private sector. We cannot afford subsidies and losses covered by taxpayers. Now they have paused the bill to give the Chagos islands to Mauritius with a ridiculous large dowry paid by UK taxpayers, they should announce this bad deal is cancelled and save us billions.

“Cutting spending when there is so much waste can be easy. These ideas would be popular in themselves. Do all of them and we could afford a tax cut and still have a lower deficit.”

- The Rt Hon Sir John Redwood, 06 Nov 2025

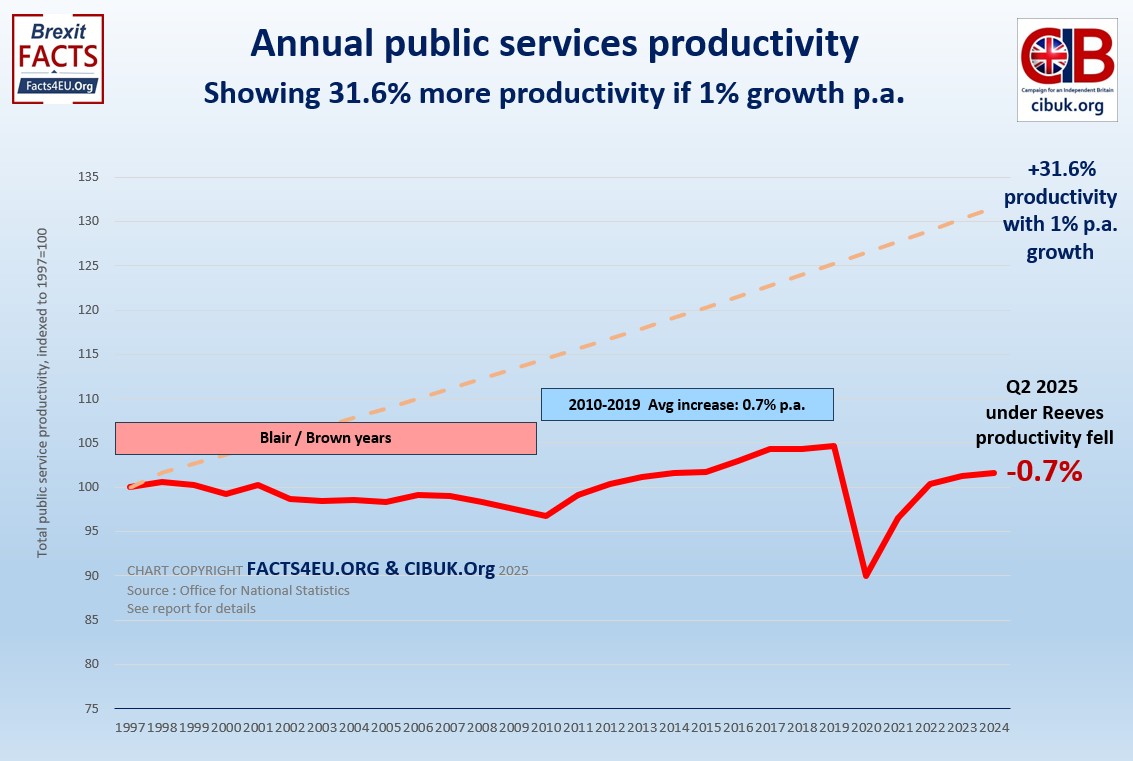

3. Despite spending doubling, productivity has not been rising

On Tuesday the Chancellor talked a lot about productivity, blaming it – as with everything else, it seemed - on what she inherited a year and five months ago. The facts tell a slightly different story, however.

Below we show the official figures for public service productivity, again from the Office for National Statistics. This shows a poor performance for many years, but in the years leading up to Covid this had been improving.

© Brexit Facts4EU.Org 2025 - click to enlarge

[Source(s) : Office for National Statistics, Nov 2025]

Crucially, what this chart shows is where we would be if we had had a nominal growth of just 1% per year in the productivity of our public services. All that extra money invested by the British taxpayer and what do we have to show for it? The dotted line on this chart shows that we could have achieved nearly 32% extra productivity.

It is disappointing the Chancellor does not seem interested in talking about cutting costs and increasing productivity. The talk all seems be about raising taxes. If the Chancellor should pursue this line, and break a firm manifesto promise, there will clearly be electoral consequences. The only conclusion that can be drawn is that she is prevented from cutting costs by her MPs. Given that the alternative is raising taxes again, this is unlikely to go down well.

“As the graph shows, productivity fell under Labour 1997-2010 as they spent more and hired more staff. It rose a bit under the Conservatives 2010-19, as they tried to get some better value out of the public sector. It fell disastrously over Covid lockdowns and still has not properly recovered despite heavy spending on remote working, online meetings, better data handling and now AI.

“The graph also shows the UK has lost out on normal, modest, annual productivity growth. We would have 32% more to play with on the costs of public services if they had just managed to improve by 1% a year, below normal private sector improvement. This would mean we could afford all our current services without the black hole in the accounts, as they would deliver them at less cost by working smarter.”

- The Rt Hon Sir John Redwood, 06 Nov 2025

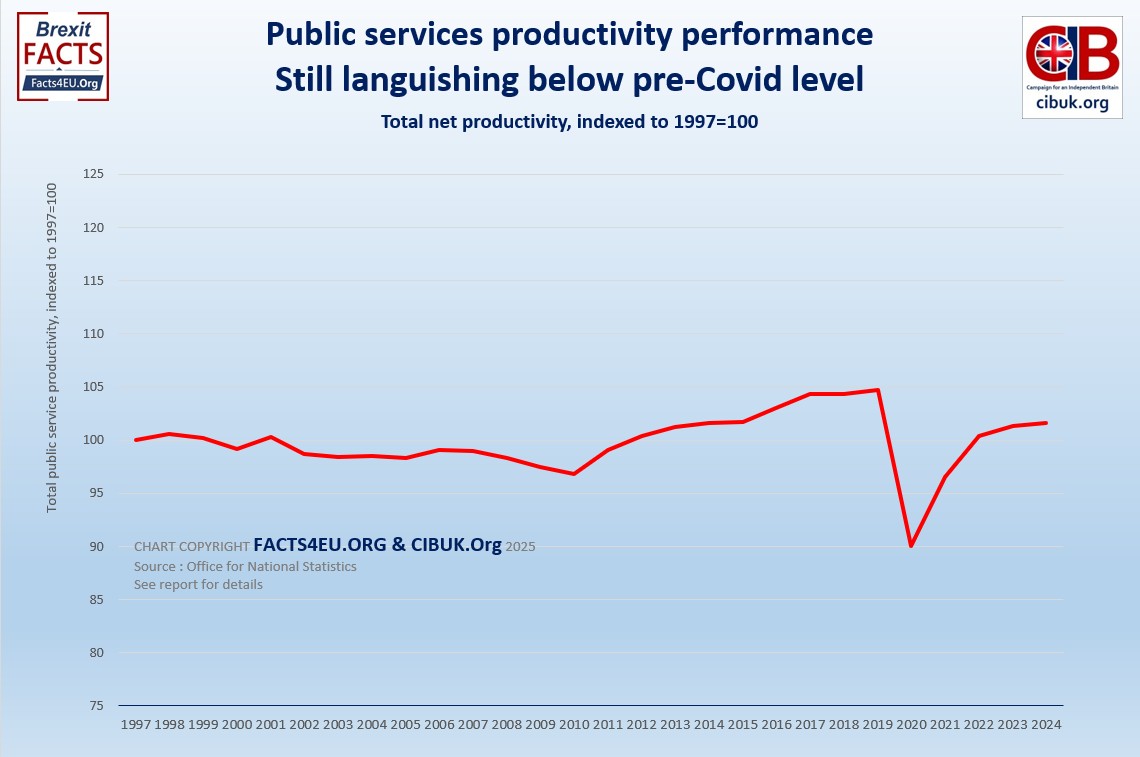

Unfortunately, post-Covid the productivity level still remains below its pre-Covid performance and growth appears to be tailing off. In the latest quarterly figures released this month, there has been a 0.7% drop in public service productivity under Ms Reeves. To get a sense of the lack of performance, below we show the two graphs side-by-side.

Productivity almost unchanged

Costs in real terms have doubled

The above clearly shows how the spend on the public sector has increased dramatically over the years but, apart from a slow rise under the Conservatives pre-Covid, productivity has not.

Observations

Readers may wish to know that we will be appearing on GB News TV this afternoon, discussing this report. We will publish details on here later, as soon as we have them.

The Facts4EU and CIBUK teams have been delighted to work with Sir John Redwood on this second 'GBN Pre-Budget Special', in association with GB News. GB News have published their report on our article which we recommend to readers.

Our report today does a number of things. Firstly it provides the factual background to some of the rather odd claims by the Chancellor in recent weeks. Watching her on Tuesday we were surprised to hear her talk about inflation again. Our research clearly shows that the current high level of 3.8% is all down to her, not Brexit or previous governments.

Secondly, It became quite obvious that she has been having internal battles within her party. When she attempted to put through some very mild changes to benefits, there was a revolt amongst backbenchers and Sir Keir Starmer was forced to retreat. The changes would only have resulted in potential savings of £5 billion - a drop in the ocean compared to the overall government spend.

One of the major revelations in this report relates to that very subject of government spending. It is little short of a scandal that spending on the public sector has more than doubled in real terms, and yet we have seen almost no effect on productivity. The public might quite justifiably ask what has happened to all those billions.

The very worrying fact is that Ms Reeves appears to be focusing all her efforts on tax rises. Even if she is merely flying a false flag on the possibility of income tax rises, only to claim triumph when she does not in fact raise them, it is the case that her focus appears to be on tax, not cost-cutting.

Knowing the markets, this could very well come back to bite her very hard. Indeed, she may well end up being Labour's Liz Truss - on steroids.

Please, please help us to carry on our vital work in defence of independence, sovereignty, democracy and freedom by donating today. Thank you.

[ Sources: Office for National Statistics | HM Treasury | Office for Budget Responsibility ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Thurs 06 Nov 2025

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget actually to post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments