Revealed: Rachel's £100bn tax bombshell – The 100 billion REAL reasons your taxes will soar again

Exclusive analysis for GB News reveals the number that blows her Budget excuses out the water

Montage © Facts4EU.Org 2025

More shocking facts and explosive charts, and Sir John Redwood's verdict: "A spending addiction"

Welcome to the third of our Pre-Budget Specials, in association with GB News

Previously in this series:

Part I: "The definitive, slam-dunk debunk of the Chancellor's false claims"

Special Supplementary: Rachel’s 10 TRILLION pound secret - Where has this money gone?

Part III (today): “Rachel's £100bn tax bombshell – The 100 billion REAL reasons your taxes will soar again”

If readers thought our first two GBN Pre-Budget Specials were shocking, this third part is incendiary. Never before has a Chancellor got in so many excuses, over so many weeks, on so many unrelated subjects. For all readers who were becoming suspicious, this exclusive report provides the facts to show you were right.

This analysis by the Brexit Facts4EU and CIBUK teams, together with the Rt Hon Sir John Redwood and in association with GB News, uses the irrefutable, latest figures from the Office for National Statistics.

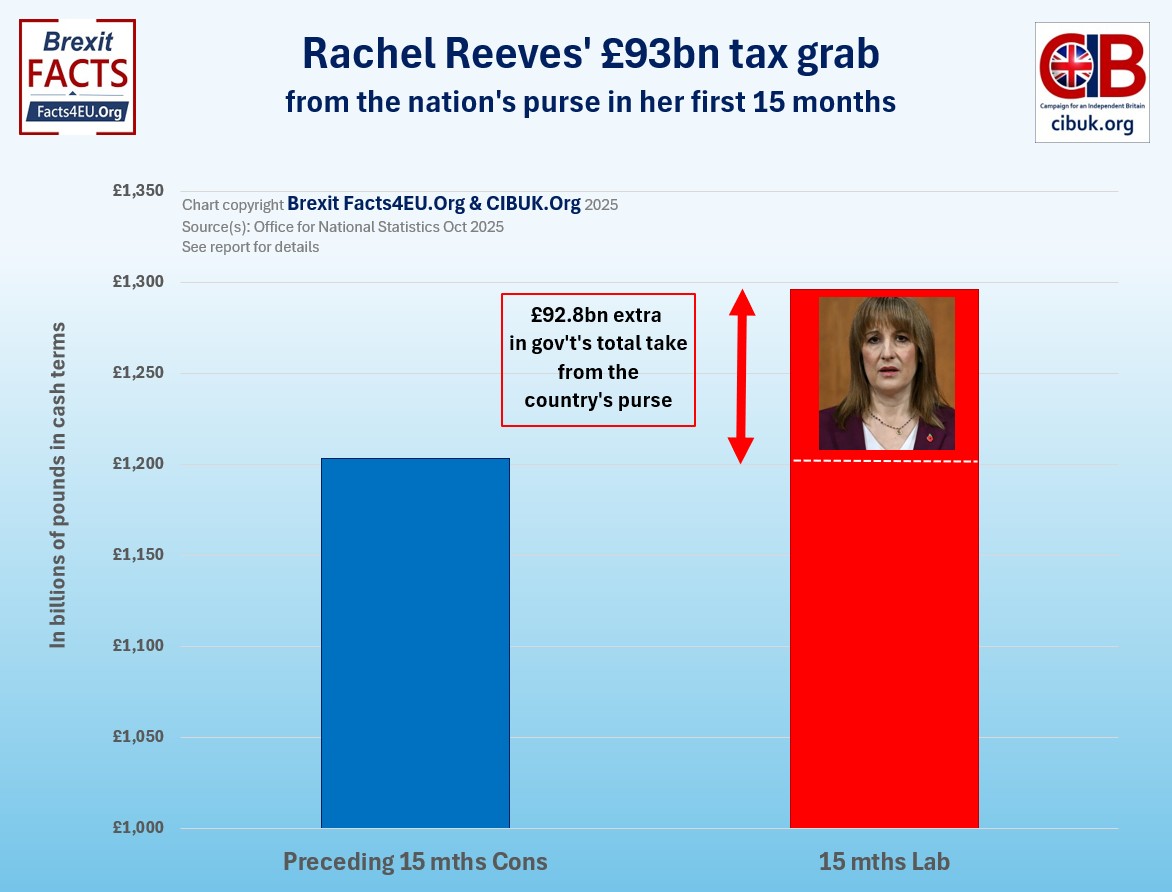

Rachel’s tax grab - £93bn MORE in all taxes in 15 months, than in the preceding 15 months

This is in cash terms – “pounds from the country’s pocket”.

In the first 15 months since Rachel Reeves has been Chancellor, the Government has taken £93 billion more from the nation’s purse in total public sector taxes and social contributions than in the same 15 month period preceding it.

By now (mid-Nov), the extra taxes taken by Ms Reeves will have exceeded £100 billion pounds.

What follows, however, uses the latest official data to end-Sept, which comes to £93bn.

From July 2024 when she became Chancellor of the Exchequer to September of this year (2025), Rachel Reeves has increased the government’s total ‘take’ by £92.8 billion pounds. This is additional, over and above the amount of taxation she inherited from the previous government.

In Part II of this GB News special series we showed how the total spend for the year 2024/25 reached £1.27 TRILLION. If she still has a 'black hole' in her accounts after taking so much more from the country's finances, questions must be asked about all the extra spending Ms Reeves committed to in her first budget.

Total public sector taxes and social contributions

Jul 2024 – Sep 2025 (15 mths), compared with Apr 2024 – Jun 2024 (preceding 15 mths)

In current prices, in £’s billions

© Brexit Facts4EU.Org 2025 - click to enlarge

[Source(s) : Office for National Statistics, accessed Nov 2025]

"Her problem is her spending addiction"

- The Rt Hon Sir John Redwood gives his views on this tax grab

“Rachel Reeves made a big tax grab last year, promising it would be a single, necessary raid, setting her up for no more more rises. She lied. Instead of creating the stability she promised, she put spending up by much more than the large tax rise. Now she needs to mug taxpayers again to pay for her runaway spending.

“The problem is her spending addiction. What maddens voters is the spending does not buy us controlled borders, safe prisons or better access to healthcare. It disappears into her black holes to pay for surging unemployment, more illegal migrants and for low productivity in public services. She struggles to pay the air fares for the ever-travelling Prime Minister and fails to get her ill-judged attempts at spending cuts through Parliament, where her party has a huge majority. Labour MPs are running out of patience with their incompetent Chancellor.

“More tax rises run the risk of damaging growth more. That puts us back in a doom loop, with lower growth cutting revenues and leaving a bigger deficit all over again.”

- The Rt Hon Sir John Redwood, 13 Nov 2025

The Rt Hon Sir John Redwood, MPhil, DPhil, Distinguished Fellow of All Souls Oxford, former MP for 37 years, former Secretary of State, former Director of Lady Thatcher's Number 10 Policy Unit.

Reaching the widest possible audience - with GB News!

This is our third ‘Pre-Budget Special’ in association with GB News.

Whilst we can reach tens of thousands – and for some reports over half-a-million – we are sure readers will agree that collaborating with ‘Britain’s News Channel’ helps our well-researched work reach a large number of people who would otherwise not see it.

As we write, ours is the fifth story on their homepage – not bad when we have to compete with Starmer’s woes, the BBC’s fake news, and the rest.

Please do your bit by clicking on the GBN image to increase page views and keep us flying high!

The Government is now taking £1 TRILLION in all its various taxes from us each year

In the last 25 years, successive governments have increased the amount of tax and social contributions from the public and businesses. They have done so progressively, year after year. The amount dropped during the Covid pandemic when so many people were prevented from working. But then the amount jumped and has kept increasing.

The chart below shows this ever-increasing tax grab starkly. These are the official figures from the Office for National Statistics, converted by the Brexit Facts4EU team into today’s money, (Sept 2025 prices). The difference between this figure of £1 trillion and the £1.27 trillion the government spent is explained by the amount the government borrowed plus some non-tax incomes.

Finally, this massive jump in spending is not explained by the population increase. This is only 17.6% over the 25 years - far less than the increase in the tax take.

Government’s tax grab, year to Sept, 2000-2025

In 2025 prices

- Year to Sept 2000 : £681 billion

- Year to Sept 2025 : £1.054 TRILLION

- Increase : 54.7% in real terms

© Brexit Facts4EU.Org 2025 - click to enlarge

[Source(s) : Office for National Statistics, accessed Nov 2025]

Would you work through the night for £1.27 per hour?

Rachel's not the only one with a 'black hole' in her accounts...

If more patriotic members of the public don't donate, we will not survive into our 11th year.

Please donate today if you would like to continue reading us tomorrow, next week, and the weeks after.

Don't leave this to someone else. You are that 'someone else'.

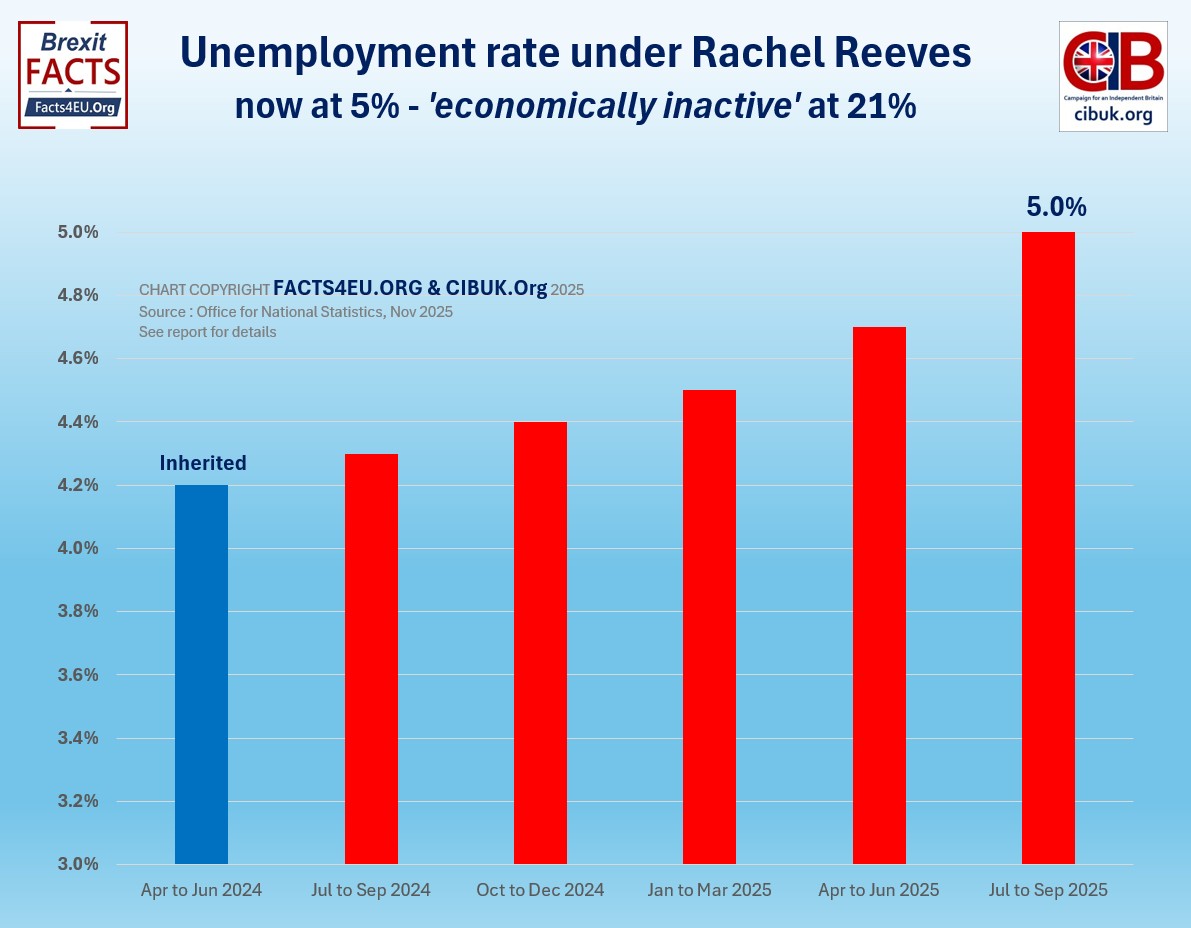

Ms Reeves’ policies seem to be having an adverse effect on employment

In July to September 2025, the UK unemployment rate increased again, to 5.0%. Meanwhile, the estimated UK employment rate decreased 0.2 percentage points. An astonishing 21.0% of those of working age were ‘economically inactive’.

Excluding the Covid period, this is the first time this has happened since June 2016, nearly 10 years ago. We and CIBUK can also reveal exclusively that male unemployment exceeded 5% in the latest figures to August and in the latest quarter's results it has risen to 5.4%. Excluding Covid, the last time this happened was a year before the EU Referendum. And all this has occurred under a Labour Chancellor...

When Ms Reeves became Chancellor, overall unemployment was still high after Covid but had dropped to 4.2%. Since then, as the chart shows, the quarterly figures have only gone one way - up.

Unemployment rate inherited by the Chancellor, and its constant rise since

- Apr to Jun 2024 4.2% (Inherited)

- Jul to Sep 2024 4.3%

- Oct to Dec 2024 4.4%

- Jan to Mar 2025 4.5%

- Apr to Jun 2025 4.7%

- Jul to Sep 2025 5.0%

© Brexit Facts4EU.Org 2025 - click to enlarge

[Source(s) : Office for National Statistics, accessed Nov 2025]

“The Chancellor found out the hard way that higher taxes can hit jobs and undermine confidence. So why do it again?”

Sir John comments on the taxes on jobs

“Many of us warned the Chancellor at the time of her first budget that imposing a big additional tax on jobs would mean fewer vacancies and more people out of work. We cautioned that increasing taxes on businesses and farms would cut investment, knock confidence and put employers off hiring staff. So it proved.

“The Chancellor found out the hard way that higher taxes can hit jobs and undermine confidence. So why do it again? Why put up income tax so it is less worthwhile working extra or at all? Does she want another year of rising unemployment many more people on benefits and another failure to bring borrowing down? Please Chancellor, change your mind and get us out of the high tax high borrowing doom loop.”

- The Rt Hon Sir John Redwood, 13 Nov 2025

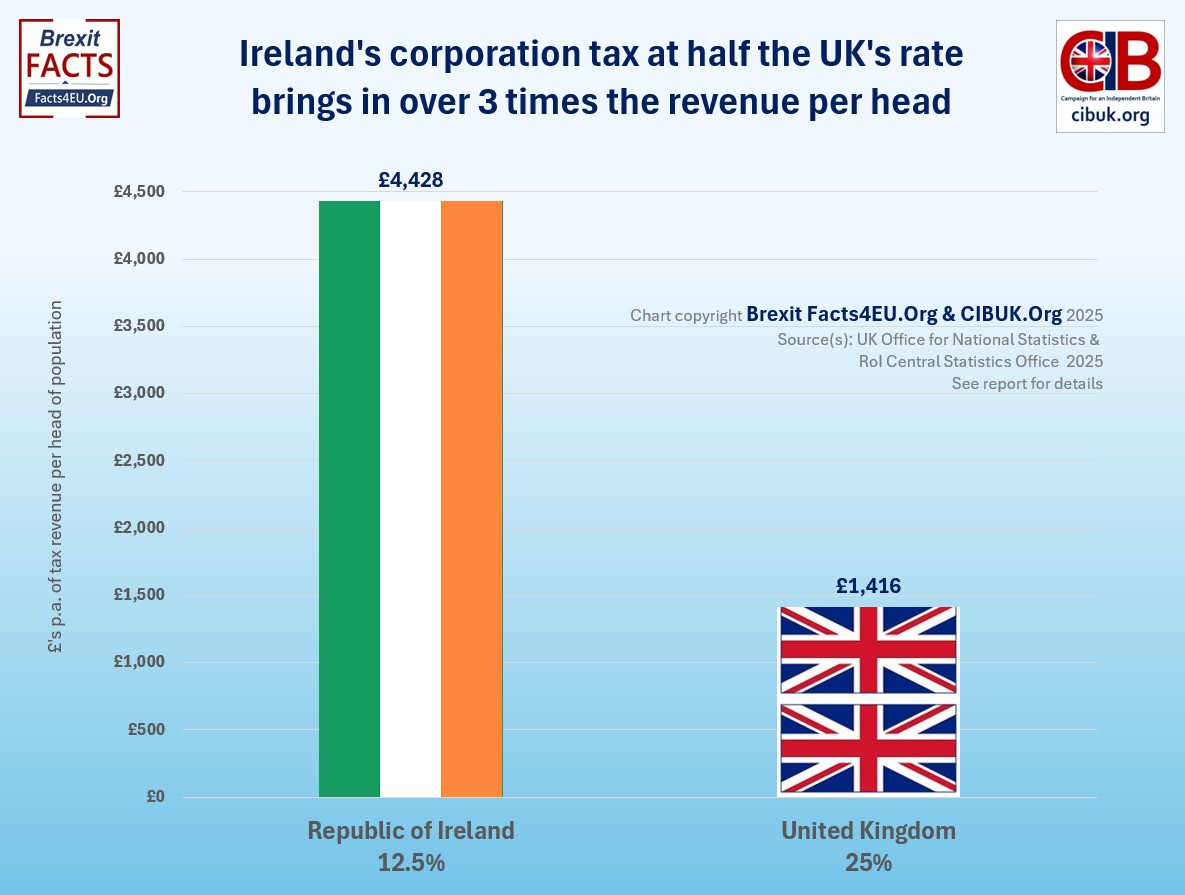

When Rachel raises taxes, it doesn't always mean higher revenues - And if that happens she'll be in real trouble

It is well-known in economists’ circles – and after all, Ms Reeves’ CV said she was a Bank of England economist for many years – that tax revenues rise as the tax rate rises, but only up to a point. If tax rates rise beyond a certain limit, which depends on the tax and who it is affecting, then revenues from the tax actually start falling.

Probably the best example of the way in which the total tax received can actually be higher with a lower tax rate is when comparing corporation tax between the UK and the Republic of Ireland. The UK’s main corporation tax rate is double that of Ireland – 25% versus 12.5%. Despite this, the Republic collects more than three times the tax revenue per head of population than the UK.

How tax takes fall when the tax rate rises

and put people off becoming liable to pay them

Corporation tax revenues per head, UK vs Republic of Ireland, 2024

© Brexit Facts4EU.Org 2025 - click to enlarge

[Source(s) : Office for National Statistics | Irish CSO]

The Rt Hon Sir John Redwood comments:

“Rachel Reeves has taxed us so much she will now find putting taxes up will in some cases lead to less revenue. Her high levels of Sprits Duty last year led to a fall in the amount collected, as people could not afford the drinks with the new super tax. Changes to toughen Capital Gains Tax meant revenues from that very avoidable tax also fell. Under Jeremy Hunt and now Rachel Reeves the UK has lost out massively on business taxes. By charging 25% to Ireland's 12.5%, the Treasury collect so much less revenue per head.

“Ireland has attracted more and more big investors and projects to Dublin which could well have come to the UK if we offered the same lower Corporation tax rate. As Facts4EU show vividly, the UK collects so much less tax per head from business than Ireland because so many of the successful US corporations now choose to base much of their activity in Ireland, not here. To get out of our current fiscal black hole we need more revenue from more growth. We would get both if only the government had the commonsense to charge a rate of business tax firms would stay to pay, and other firms would come to help them flourish.

“Just as the Rachel Reeves higher taxes are killing jobs and the employment market, so are her business taxes killing investment. They put off new companies coming to the UK in the first place. No wonder the UK is in the slow lane with the EU and not in the fast lane with the USA.”

- The Rt Hon Sir John Redwood, 13 Nov 2025

Observations

If you were given 100 billion pounds, how quickly could you spend that amount? We're talking billions here, not millions. Each one is 1,000 million pounds. And you have 100 of them.

Let's make it easier. Let's say you 'only' have one billion pounds. That's 10 million per year for one hundred years.

Naturally we are being a little disingenuous. The Chancellor needs to cater for the entire population and all the country's needs, such as national defence. Nevertheless we wanted to try to give an idea of the scale of the increase in taxation that Rachel Reeves has raised from us all, including all businesses. This isn't the total spend - that's £1.27 TRILLION and we're not even going to try to explain how much that is. The £100 billion is merely the increase in taxation that the Government has taken in its first 15 months in office.

In her pre-Budget 'scene-setting' statement she made from No.10 which we reported on, Ms Reeves referred more than once to the £10 billion per annum the government is spending on servicing the country's massive debt, purely to pay the interest. If we inherited a situation like that, our first inclination would be to balance the books so the debt was not increasing. We would cut costs, before asking the public for yet more money.

We would then go further and start reducing the annual expenditure, to start reducing the debt and possibly start to make tax cuts to encourage growth, leading to a virtuous circle. The more growth, the more we could reduce the debt and make more tax cuts.

The last thing we would do is increase taxes after increasing them so much a year ago. That only leads to the 'doom loop' that Sir John was talking about above.

Please, please help us to carry on our vital work in defence of independence, sovereignty, democracy and freedom by donating today. Thank you.

[ Sources: Office for National Statistics | Office for Budget Responsibility | Irish statistics agency OCS ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Thurs 13 Nov 2025

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget actually to post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments