The UK didn’t just dodge an EU bullet, it dodged a 1 trillion euro bazooka of debt

A Facts4EU.Org analysis of the colossal EU debt we avoided, thanks to Brexit

Montage © Facts4EU.Org 2024

We reveal the cost to British households which would have happened, if not for Brexit

In 2020 the EU as a collective body started on a series of programmes of huge borrowing on the world’s money markets. This debt is on a phenomenal scale and all EU countries are liable for it.

In today’s report we summarise the extent of this borrowing and reveal how narrowly the UK escaped, thanks to Brexit.

Brexit Facts4EU.Org Summary

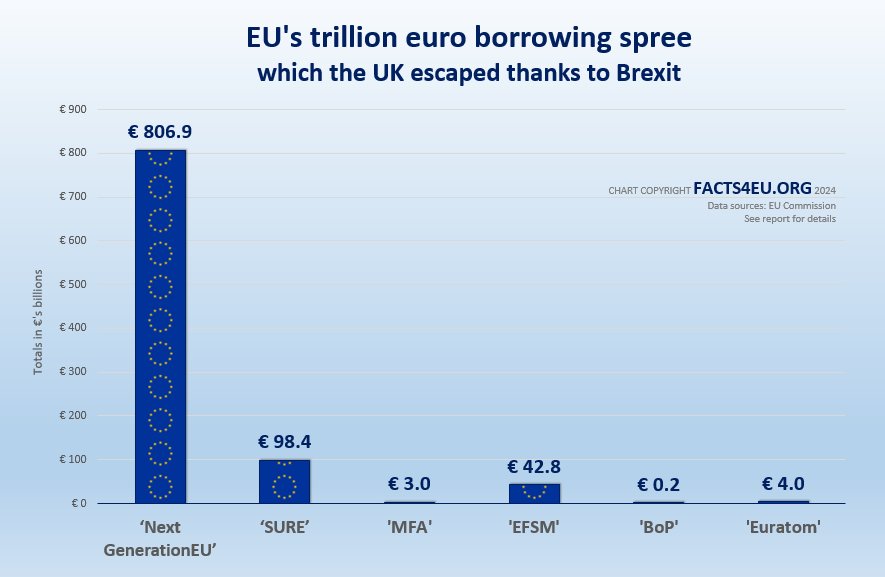

Mostly starting in 2020, the EU started borrowing on a huge scale, for the following

- ‘NextGenerationEU’ : €806.9bn

- ‘SURE’ : €98.4bn

- ‘MFA’ : €3.0bn

- ‘EFSM’ : €42.8bn

- ‘BoP’ : €0.2bn

- ‘Euratom’ : €4.0bn

- TOTAL : €955.3bn

This does not include the EU Commission’s plans going forward this year or in the coming years. Our analysis shows the EU has already disbursed €544.6bn of this debt.

[Source: EU Commission. Caveat - The EU’s finances are so opaque we cannot be sure we have captured all the borrowing but all the above and what follows are based on detailed research from Commission documents.]

© Brexit Facts4EU.Org 2024 - click to enlarge

Without Brexit, how much would this have cost UK households?

The United Kingdom's share of this debt burden would have been around 15%, or €143.3bn. This equates to £4,300 GBP extra debt for every household in the UK. [Sources: Office for National Statistics and EU Commission.]

And this is before the extra borrowing the EU Commission is planning.

The Facts4EU think-tank asked the experienced Sir John Redwood for his comments on our report

The Rt Hon Sir John Redwood MP told us

"Facts4EU are the only ones to see the debt elephant in the EU room. No sooner had the UK left than the EU went on a borrowing binge. They plan to borrow around a massive 1 trillion Euros. The member states have to stand behind that debt and pay more money to the EU to pay all the interest.

The UK's share if we had stayed in would be a crippling £4,300 per family. There's a huge Brexit win. Thanks to Facts4EU for telling us that we cannot be trampled by this debt elephant following Brexit."

- The Rt Hon Sir John Redwood, MP for Wokingham and former Secretary of State, commenting to Facts4EU.Org and CIBUK.Org, Fri 02 Feb 2024

These funds all have ridiculous names, such as ‘NextGenerationEU’

We start with ‘NextGenerationEU’. Here is what the Commission says about it.

“NextGenerationEU is the EU's €800 billion temporary recovery instrument to support the economic recovery from the coronavirus pandemic and build a greener, more digital and more resilient future. The Commission's inaugural NextGenerationEU issuance took place in June 2021.”

The Commission disingenuously says that

“Up to €385.8 billion funds loans to individual Member States. These loans will be repaid by those Member States. Should Member States not request the full envelope of loans available under the facility, the remaining amount of loans will be used to finance REPowerEU, a programme to accelerate the EU’s green transition.”

The Commission fails to say that the remainder, making up a combined total of €806.9bn, also represents a liability for all 27 EU countries, whether in the form of loans or grants.

‘SURE’

SURE is the EU programme to finance short-term employment schemes across the EU and keep people in jobs. The total funding raised under the programme in the short period between October 2020 and December 2022 was €98.4 billion, with the EU becoming responsible for ”the world’s largest social bond scheme”.

All SURE funds were raised through back-to-back issuance of SURE social bonds. This saw the Commission become one of the world’s most significant ‘environmental, social, and governance (ESG)-label issuers’, with SURE bonds accounting for 16% of global social bond issuance in 2021. That means debt, with the EU27 on the line.

‘Macro-Financial Assistance’ (MFA)

MFA is a form of financial aid extended by the EU to non-EU countries experiencing a balance of payments crisis. It takes the form of medium/long-term loans or grants, or a combination of these.

MFA beneficiaries include Albania, Bosnia-Herzegovina, Georgia, Jordan, Kosovo, Moldova, Montenegro, North Macedonia, Tunisia, and Ukraine.

On 22 April 2020, the Commission adopted a proposal for a €3 billion MFA package.

‘The European Financial Stabilisation Mechanism’ (EFSM)

The EFSM was created for the EU Commission to provide financial assistance in the form of back-to-back loans to any EU countries experiencing or threatened by severe financial difficulties.

The EFSM was used to provide financial assistance to Ireland and Portugal between 2011 and 2014, and to provide short-term bridge loans to Greece in July 2015. At the end of 2023, the European Commission had €42.8 billion in EFSM debt outstanding.

Today, euro area countries in need of financial assistance are expected to turn to the European Stability Mechanism (ESM), a permanent intergovernmental institution. However, the EFSM remains in place and can be used if the need arises.

‘Balance of Payments’ (BoP)

The EU offers BoP assistance to EU countries outside the euro area that are experiencing or threatened by difficulties regarding their balances of payments.

BoP assistance takes the form of back-to-back, medium-term loans. At the end of 2023, the EU Commission still had €0.2 billion in BoP debt outstanding.

‘Euratom Bonds’

Finally we come to Euratom bonds. The Commission is empowered to issue bonds on behalf of Euratom to finance back-to-back loans for investment projects related to nuclear power safety and decommissioning in EU AND in non-EU countries. The total amount of lending for these activities is €4 billion, of which €3.67 billion has already been allocated.

Observations

As we stated in our report, the EU’s finances are almost impossible to fathom from the available data. What we have shown is what we know about. We have not included future spending and borrowing plans, nor funds which are ordinarily part of the EU’s annual budget.

What we can say for certain is that by voting to leave the EU the British people avoided a liability for borrowing on an epic scale. By leaving the EU, households in the UK will be thousands of pounds better off.

Another huge benefit of Brexit.

We must get reports like this out there

Reports like the one above take far longer to research, write and produce than many people realise. If they were easy, readers would see other organisations also producing these daily. However, there’s little point in the Facts4EU.Org team working long hours, seven days-a-week, if we lack the resources to promote them effectively – to the public, to MPs, and to the media. This is where you come in, dear reader.

Facts4EU.Org needs you today

We are a 'not for profit' team (we make a loss) and any payment goes towards the actual work, not plush London offices, lunch or taxi expenses, or other luxuries of some organisations.

We badly need more of our thousands of readers to become members, to support this work. Could this be you, today? It's quick and easy, we give you a choice of two highly secure payment providers, and we do NOT ask you for further support if you pay once. We just hope you keep supporting us. Your membership stays anonymous unless you tell us otherwise.

Please don't assume that other people will keep us going - we don't receive enough to survive and we need your help today. Could you help us? We rely 100% on public contributions from readers like you.

If you believe in a fully-free, independent, and sovereign United Kingdom, please join now by clicking on one of the links below or you can use our Support page here. You will receive a personal, friendly ‘thank you’ from a member of our team within 48 hours. Thank you.

[ Sources: EU Commission | The Rt Hon Sir John Redwood MP ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Fri 02 Feb 2024

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget actually to post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments