The EU’s environmental taxes are an average 26% higher than Brexit Britain’s

We may not like them, but at least these Net Zero taxes are lower in the UK than in the EU

Montage © Facts4EU.Org 2023

Brexit Facts4EU reveals how much we’re paying for Net Zero, compared to the EU

Last week the Office for National Statistics released its latest data for ‘environmental’ (Net Zero) taxes in the UK. The total raised was a staggering £47.4 billion in the UK in 2022, up 6.9% from the previous year.

With the total likely to hit £50bn this year, Brexiteers can at least comfort themselves with the knowledge that we’re paying considerably less than in the average EU27 country.

Nevertheless, it is still the case that senior MPs such as the Rt Hon Sir John Redwood MP has been unable to get any impact assessment from the Government on the cost of all the measures we outline below.

Brexit Facts4EU.Org Summary

Environmental (or ‘Net Zero’) taxes in the United Kingdom

- Environmental taxes, using an internationally agreed framework, raised £47.4 billion in the UK in 2022, up 6.9% from the previous year

- Environmental tax revenue was 1.9% of gross domestic product (GDP) in 2022

- Environmental taxes provided 5.3% of all UK tax and social contribution revenue in 2022

- Average environmental taxes paid by households in the UK was £575 per household in 2020

- Energy tax revenue comprised 74.7% of all UK environmental tax revenue in 2022, followed by transport (22.3%), and pollution and resource (3.0%) taxes

- Fuel Duty remains the largest energy tax, comprising around 70% of energy taxes in 2022

- The Plastics Packaging Tax raised £207 million, 15% of pollution and resources taxes

- In 2020, the Electricity and Gas sector overtook the Transportation and Storage sector as being the largest environmental tax revenue industry contributor

[Source: Office for National Statistics.]

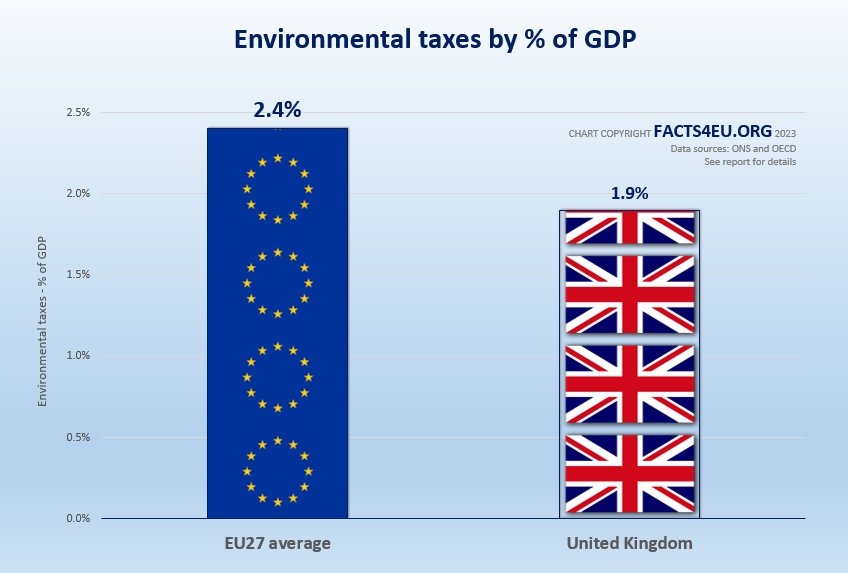

How does the UK compare with the EU?

The Office for National Statistics says :

“Environmental tax revenue for the UK as a percentage of GDP is low compared with EU countries.”

They are correct. Using the OECD’s data from 2021, (the latest available), it is possible to compare the UK with the EU27, looking at the proportion of GDP represented by these taxes. The EU27 average in 2021 was 2.4%. This is 26% higher, proportionately, than the UK’s 1.9% in 2022.

Brexit Facts4EU.Org Summary

The UK’s and the EU27’s environmental taxes, as a proportion of GDP

- EU27 average: 2.4%

- United Kingdom : 1.9%

[Sources: Office for National Statistics, OECD.]

© Brexit Facts4EU.Org 2023 - click to enlarge

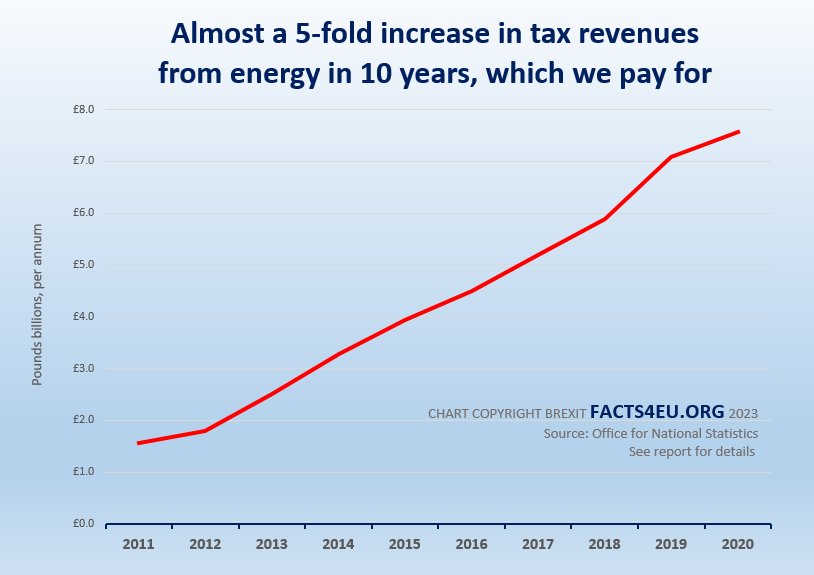

The energy sector has been worst hit - almost 5-fold tax increase

When looking at the sectors that have been worst hit by environmental taxes it probably will not surprise readers to learn that the energy sector has been worst hit.

Below we show the extraordinary surge in ‘Net Zero’ style taxes on electricity, gas, steam, and air conditioning supply. This sector is now the largest contributing industry to environmental tax revenue and of course it is the public who ultimately pay the price. In the UK in 2022, taxes on hydrocarbon oils (Fuel Duty) remained the largest contributor to revenue from energy taxes (around 70%).

Brexit Facts4EU.Org Summary

The massive rise in environmental taxes on the energy sector in 10 years

- 2011 : £1.56bn

- 2020 : £7.57bn - an increase of 4.8 times in just 10 years

[Source: Office for National Statistics.]

© Brexit Facts4EU.Org 2023 - click to enlarge

As the ONS says :

“Certain applicable tax rates to this sector, such as the Climate Change Levy, have also increased over time.”

The list of ‘environmental taxes’ keeps on growing

Here is the current list of the major areas of taxation in regard to Net Zero :-

Taxes on hydrocarbon oils (or Fuel Duty)

Paid on motor and heating fuels produced, imported or used in the UK.

Climate Change Levy

This is a tax on non-domestic use of energy, introduced in April 2001. Carbon Price Floor taxes were introduced from 1 April 2013.

Renewable Energy Obligations

Introduced in 2002 to provide incentives for the deployment of large-scale renewable electricity in the UK.

Emissions Trading Scheme (EU-ETS and UK-ETS)

EU-ETS is a multi-country, multi-sector greenhouse gas emissions trading scheme introduced by the EU. It applied from 2009. From 01 January 2021 the UK Emissions Trading Scheme replaced this.

Air Passenger Duty

From 1995 a duty on the carriage from a UK airport of chargeable passengers on chargeable aircraft. The amount due is dependent on the final destination and class of travel of the chargeable passenger.

Rail franchise premia

The process of rail franchising was first introduced by the Railways Act 1993. The first franchises came into effect in 1996.

Plastic Packaging Tax

Introduced in 2022, this tax is intended to encourage the use of recycled plastic. It applies to the manufacture or import of plastic packaging components or packaged goods that does not contain at least 30% recycled plastic.

Observations

We may not like the idea of enviroment taxes costing nearly £50 billion but at least these taxes are a lot lower in the UK than in the EU. The cost to each UK household in 2020 (the last data available) was an average of £575.

When it comes to energy taxes, of course Fuel Duty is one of the most hated of them all. Our research shows that they comprised around 70% of all energy taxes in the UK last year.

We must get reports like this out there

Reports like the one above take far longer to research, write and produce than many people realise. If they were easy, readers would see other organisations also producing these daily. However, there’s little point in the Facts4EU.Org team working long hours, seven days-a-week, if we lack the resources to promote them effectively – to the public, to MPs, and to the media. This is where you come in, dear reader.

Facts4EU.Org needs you today

We are a 'not for profit' team (we make a loss) and any payment goes towards the actual work, not plush London offices, lunch or taxi expenses, or other luxuries of some organisations.

We badly need more of our thousands of readers to become members, to support this work. Could this be you, today? It's quick and easy, we give you a choice of two highly secure payment providers, and we do NOT ask you for further support if you pay once. We just hope you keep supporting us. Your membership stays anonymous unless you tell us otherwise.

Please don't assume that other people will keep us going - we don't receive enough to survive and we need your help today. Could you help us? We rely 100% on public contributions from readers like you.

If you believe in a fully-free, independent, and sovereign United Kingdom, please join now by clicking on one of the links below or you can use our Support page here. You will receive a personal, friendly ‘thank you’ from a member of our team within 24 hours. Thank you.

[ Sources: Office for National Statistics | OECD ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Sat 13 May 2023

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget to actually post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments