“Substantial long term gains to the UK” from Brexit, says major academic study

Professor Patrick Minford and team write exclusively for Brexit Facts4EU and CIBUK

Montage © Facts4EU.Org 2023

We summarise Professor Minford’s paper and link to the full version

Today we publish exclusively a detailed academic report on the effects of Brexit, from the distinguished Professor of Applied Economics, Patrick Minford, and his team from the prestigious Cardiff Business School, Cardiff University. This is one of our rare departures from our normal shorter pieces, but we hope at least some of readers will appreciate it.

What follows is an extract from an impressive body of work on the economic impacts of Brexit. The full repart is not ‘dressed up’. It presents the facts in all their detail – good and bad. Professor Minford and his team do not comment on the politics of this. They focus on an objective analysis of economic data and its modelling. What is striking is how far removed from the OBR’s fanciful forecast of 4% lower growth in GDP over the next five years (allegedly due to Brexit) this new report provides. We comment on this in our 'Observations' below the report.

The full report – at 25 pages – is of course complex and will not be something everyone will want to read. We are therefore publishing an ‘executive summary’ as well as an abbreviated extract courtesy of Professor Minford, whilst also publishing a link to the full report.

Brexit Facts4EU.Org Summary

How can it be possible to discern a Brexit effect in all the volatility we have experienced?

- "Eliminating the barriers to these import categories that we inherited from the EU - which are estimated to average about 20% - would increase UK GDP in the long run by around 6%.”

- "A big gain, very many times the official estimate - and would lower consumer prices by 12%.”

- "This assumes trade does not grow, as of course it will, given that Asia is a fast growing part of the world economy.”

- “We find some significant effects of disruption from Brexit but they are temporary and quite small, with slightly negative effects on GDP, exports and imports, and slightly positive effects on inflation and interest rates”

- Other studies “forget all the shocks to these other countries coming from their own economies after Brexit. These shocks will create differential effects for this group; under this procedure these shocks and not just Brexit will cause a difference from the UK to emerge. There is simply no way of saying it is just Brexit.”

- “One of the major objectives of Brexit is to replace the EU’s intrusive precautionary principle with the pragmatic common law principles under which experimentation is permitted to enable vigorous innovation.

- “As long as EU regulations are left in place by default, their replacement is delayed by bureaucratic inertia. As nature abhors a vacuum, so the abolition of remaining EU regulations should stimulate the necessary consultations to produce new UK-based regulation.

- “The gains from this change in regulation were estimated at 6% of GDP using the supply-side of the UK model.”

Modelling the effects of Brexit on the British economy

By Patrick Minford, Professor of Applied Economics, and his team from the prestigious Cardiff Business School, Cardiff University

Introduction

There has been a lot of recent comment in the UK media to the effect that Brexit has damaged the UK economy and its trade, for example, from LSE’s Dr. Swati Dhingra in oral evidence to the Commons Treasury Committee, and also recent comments in the FT. Yet these claims are puzzling, given the numerous shocks that have hit both the world generally and the UK in particular, including Covid and the Ukraine war; it has been vigorously disputed by Graham Gudgin, Julian Jessop and Harry Western. How can it be possible to discern a Brexit effect in all this volatility?

The issue when so many shocks are impacting on the economy, is to sort out the wheat from the chaff and identify the Brexit element in them all. In principle, the way to do this is to set out a ‘normal relationship’ determining the economic variables of interest and then to identify the point of time at which the Brexit element intervened; this key date of Brexit arrival then allows us to identify the Brexit effect mathematically as a shift in the relationship definitely due to Brexit owing to its coinciding with that date.

This ‘event study’ analysis depends critically on the ability to tie the effects of Brexit to a particular date or dates. Because there are so many other shocks occurring before and after this event, two questions arise. One is that of identification: could these other shocks have had effects at these times? We can attempt to answer this by either excluding or somehow controlling for these other shocks. Another question is whether any estimated effect is sufficiently large for us to be confident it could not have occurred by chance, due to general shock volatility, rather than due to the event- here Brexit. We judge this in a standard way, as what could occur with up to 95% probability; if the estimated effect exceeds this, it would only have a 5% chance of occurring and so we consider that the event most probably had an effect.

Accordingly, we have looked carefully for such effects on the relevant UK data; they should show up as statistically significant effects of the date of Brexit in appropriate regression relationships of UK variables on their determinants. Of course, the data has notoriously been highly volatile due to the major shocks just noted. This militates against finding significant Brexit effects, as common sense indicates. To anticipate our findings, we find some significant effects of disruption from Brexit but they are temporary and quite small, with slightly negative effects on GDP, exports and imports, and slightly positive effects on inflation and interest rates.

Identification of Brexit effects

To identify the short run effects of Brexit we have to use the dates when Brexit occurred - i.e. the 2016 referendum result and the end-2020 exit from the EU Single Market - as our variables of identification, on the assumption that what happened to economic events then reflected the effects of Brexit and only these. Even simply on UK data this is quite a demanding assumption as other shocks coincided with these events- notably Covid but also government policy actions on various fronts. However, it is the best identifying strategy we have.

Some studies, notably by John Springford, have used the differential between UK behaviour and the behaviour of a ‘doppelganger’ weighted set of 30-odd other countries as their dataset and assumed that changes in the differential from the date of Brexit in 2016 identify the effects of Brexit. However, this procedure makes no sense. It operates by finding a weighted average of 30-odd countries that gets as close as possible to the UK pre-Brexit. In a group of 30 countries it will always be possible to find a few that for the variable in question - GDP, investment, exports etc - happened to come out close to the UK; then one simply raises the weights on those countries until the group gets closest to matching the UK. The next stage is to argue that it would continue to mimic the UK into the future had there been no Brexit. But this forgets all the shocks to these other countries coming from their own economies after Brexit. These shocks will create differential effects for this group; under this procedure these shocks and not just Brexit will cause a difference from the UK to emerge. There is simply no way of saying it is just Brexit.

Thus to give Brexit effects the best chance of being identified we need to estimate UK data behaviour alone and apply the Brexit dates to that, to find the short run effects on the macro economy. Then we can argue that shifts in the UK relationships over those dates are due to Brexit. We know the form that these UK relationships will take, by dint of estimating them over the past and checking that they correspond to what we expect from our models of the UK economy. Basically, these relationships are between current and past values of the main variables in the economy: GDP, inflation, interest rates, the exchange rate, exports and imports. We can then check if they shift after the Brexit dates.

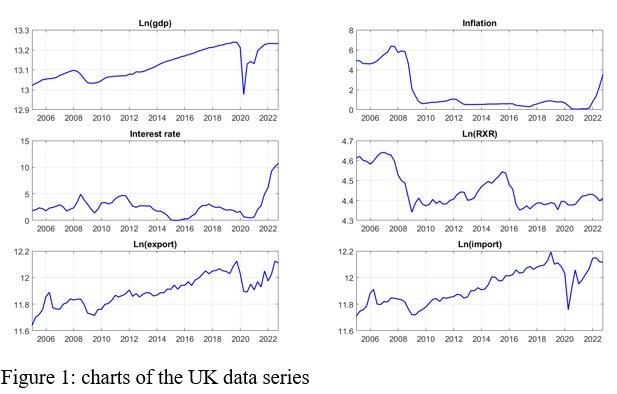

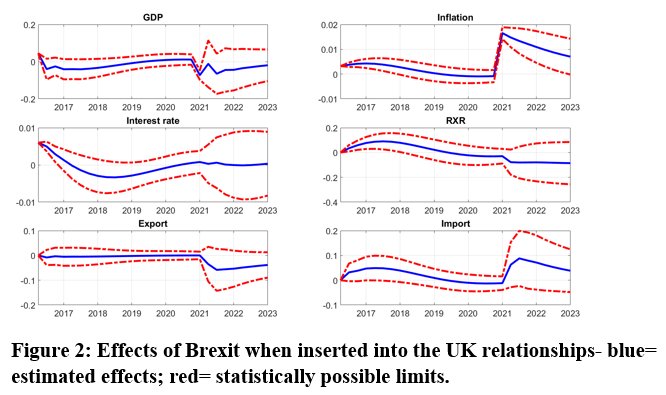

First, it helps to look at charts of all the data - Figure 1- because it is obvious from cursory inspection that all the series are dominated by the huge shocks coming from Covid. Nevertheless we can find statistically valid evidence of Brexit effects, as we would expect. We then trace out their joint effects as time goes by according to these relationships - Figure 2. It can be seen that there are effects on all the variables but that they all steadily die out.

Figure 1: charts of the UK data series

© Prof Patrick Minford 2023 - click to enlarge

Table 1 Variable definitions

- Export EU - Exports trade goods & services EU, SA - ONS

- Export non-EU - Exports trade goods & services Non-EU, SA - ONS

- Import EU - Imports trade goods & services EU, SA - ONS

- Import non-EU - Imports trade goods & services Non EU, SA - ONS

- RXR Exchange rate v Rest of Wld, price-adjusted - BoE

- UK GDP GDP, Chained Volume measure (CVM), SA - ONS

Variable - Definition - Source

Figure 2: Effects of Brexit when inserted into the UK relationships- blue= estimated effects; red= statistically possible limits.

© Prof Patrick Minford 2023 - click to enlarge

So, as can be seen, in the short run what we find is that there are temporary effects on GDP, exports and imports (slightly negative), and on inflation and interest rates (slightly positive). What we see is a set of fairly minor temporary effects, consistent with modest disruption from introducing a border with the EU - a border due to be made barrier-free and seamless by the TCA.

We still need to raise funding for the editing of our 'The Independence Documentary'

Together with our partners at CIBUK.Org, we've organised a TV-style documentary with a stellar line-up of well-known politicians and all kinds of interesting people, young and old, men and women, white and ethnic origin, presented by Alexandra Phillips.

Alex will be known to many readers as an ex-GB News presenter and a frequent sight on everything from Question Time to Talk TV.

We have finished filming - now we have the long task of editing by our professional production team, if we can get some extra funding. This is going to be big!

Please help today if you can: click here to read more

The long run effects of Brexit

So far, we have just considered the short run effects of Brexit disruption due to the insertion of a new border between the UK and the EU; for this we have brought to bear proper statistical methods on a confused public debate. However, the long run effects of Brexit are of much greater importance because both larger and permanent. Also, in our view they are to be seen as gains, not losses. In the following sections we survey previous estimates of these long run effects, including our own. We will argue that the widely repeated ‘Remainer’ view that there are losses is quite wrong, and that instead there are substantial gains.

The economic gains for Brexit I envisaged to come from three directions and to accrue over the long term. First, there would be free trade with the rest of the world in place of high EU protection of agriculture and manufacturing. Second, there would be replacement of tightly prescriptive EU regulation in the tradition of Napoleonic law by pragmatic UK regulation in the tradition of the common law. Third, there would be control of immigration to ensure that those coming- from anywhere in the world - had the skills necessary to bring a net economic contribution to the UK, in place of an automatic right of entry to any EU citizen.

The key dispute over these gains has been over trade. They would come as set out above in the ‘classical’ long run model of trade. Those opposed to Brexit have put forward an alternative ‘gravity’ model which assumes that the greater the distance in trade the less the effect of cost differences in shifting trade; we will see below that this model is close to the short run relationships we have used to calculate the short run effects. When these are combined with the assumption that the border barrier between the UK and the EU is large and permanent, then they predict a loss from Brexit due to large UK-EU trade displacement. However, we will argue that this assumption is false and also that the gravity model is rejected by the data as a model of long run trade.

Free trade: there has been a large-scale rollout of free trade agreements

Britain has just signed a highly significant trade agreement with nearly a dozen Asian countries- the Comprehensive and Progressive Agreement for Trade Partnership, the CPTPP; call it the Trans-Pacific Partnership, TPP, agreement for short. According to the Department of Trade’s official assessment the TPP will add 0.08% to UK GDP in the long run, which has been derided by anti-Brexit opinion as negligible compared with the supposed loss of GDP due to lower EU trade, set at 4% of GDP by the UK’s Office for Budget Responsibility.

These official estimates are based, as noted, on ‘gravity’ models which assume that trade effects of trade liberalisation fall off the higher the distance of a trade partner; and on the assumption that trade barriers with the EU must be raised by Brexit in spite of the Trade and Cooperation Agreement, TCA, with the EU whose aim, as noted above, is precisely to eliminate trade barriers between the UK and the EU.

Start with the second; it takes time first for negotiations on numerous details to be concluded, as the long discussions on implementing the NI protocol illustrate. It also takes time for people and businesses to adapt to the new border processes. But as the recent agreement on the Northern Ireland Protocol show, they eventually succeed. It is reasonable to assume that other details will similarly be sorted out over time; hence we should assume the TCA achieves its long run objective of removing trade barriers with the EU, in which case there will be no long run EU trade effects.

Now turn to the first issue of the gains from wider trade agreements, found to be minimal by the official model used. In our trade modelling work at Cardiff University we have repeatedly tested the ‘gravity’ model on different countries’ data and found it to be widely rejected. The reason is that while of course ‘gravity’ (i.e. distance and size) does affect the extent of trade by itself, the effects of trade liberalisation and other changes over time have rather similar effects on all trade and they work by bringing down national prices into line with world competition; a model along these lines is generally consistent with the data. The ‘gravity’ model that says they have limited price effects and disproportionately affect nearer and larger trade partners is generally rejected by the data - chapter 2 of my recent book describes in some detail the wide variety of these gravity models applied to UK trade.

The TPP countries currently account for about 6% of our trade in goods - largely food and manufactures. But the key point totally missed in the official assessment is that our importers will now have a barrier-free source of these goods for them to access if they need to, which via competition will reduce our import prices on them to world levels. This in turn impacts on our consumer choices and our production structure. Eliminating the barriers to these import categories that we inherited from the EU - which are estimated to average about 20% - would according to our detailed model of UK trade and the economy increase UK GDP in the long run by around 6% - a big gain, very many times the official estimate - and lower consumer prices by 12%. This is the ‘static’ benefit, assuming trade does not grow, as of course it will, given that Asia is a fast growing part of the world economy.

A natural reaction to this estimate will be that, just as the official one was far too small, this one is extravagantly large. It is certainly true that it is based on a long term assessment, not the short term gravity models used by opponents of Brexit. It also assumes that in the long term there is free trade within this Pacific bloc which is the aim of the TPP; the initial agreement is hedged about with quota restrictions on the amount that can be freely traded but these should be eventually phased out as markets develop and confidence expands that they are not disrupting them; UK businesses will be incentivised to accept easier import access by the reciprocal access for their exports. Furthermore the TPP is due to expand as new members join; those interested include S Korea, Thailand, several Latin American economies and both Taiwan and China. The US could also return to being a member. As it expands the TPP will reinforce these competitive effects on the UK economy. The gravity models used to condemn Brexit are short term in focus, not much different from the ‘macroeconomic’ models we use for analysing the business cycle, and which we used above to calculate the short run effects of Brexit disruption. Hence they are inappropriate for calculating long run gains.

How this free trade agenda leads to a full Brexit with EU irrelevance

Because of the short term focus of the current Whitehall consensus gravity model, it is not well understood just what radical implications this free trade has for the UK’s future relations with the EU. As we have seen in the long term free trade implies equalisation of our home prices with world prices, which in turn means that we would export to the EU at these very same prices and would only import from the EU goods that were priced at the same competitive level.

This means that any threats by the EU to levy tariff or other trade barriers on UK goods in the course of any future negotiations on the TCA and any proposed new UK regulations, would be entirely empty. The reason is simple enough; UK export prices to the EU would be unaffected, as for example should they fall, UK goods would be diverted to other world markets at the full world price. Hence any EU trade barriers would simply raise the prices paid for UK goods by EU consumers. Should EU sales suffer as a result, then more goods would be sold elsewhere at world prices.

Similarly, if the UK were to raise barriers against EU imports in retaliation against any such EU barriers, it would not affect UK prices of these imports as they would have to compete with world imports to be sold at all. As a result EU sellers’ prices would be reduced. If as a result they supplied less imports, these would be replaced by imports from elsewhere.

It follows that the TCA itself would become irrelevant, dominated as UK trade with the EU would now be by the prices prevailing in the world at large. Furthermore, the EU would get most welfare from UK trade free of barriers as this would keep down the prices of UK goods to its consumers and keep up the prices of its UK exports to world prices. Hence we would expect that UK relations with the EU would default to barrier-free trade. As for UK regulations, the UK would be entirely free to set them as it suited it best, free of EU trade threats.

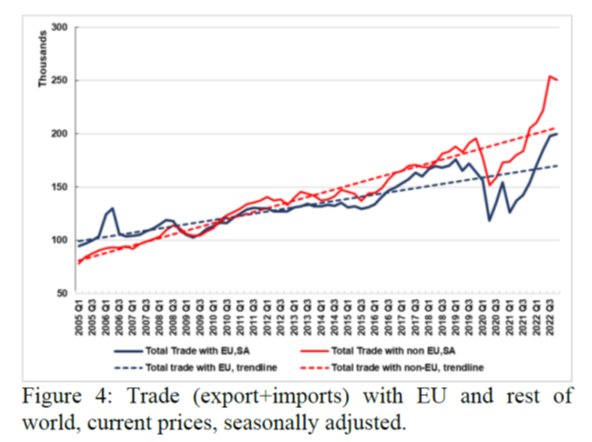

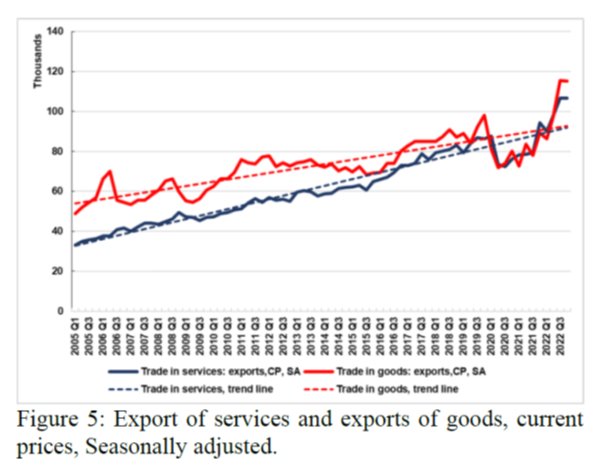

Two implications of the trade model used here are that the share of non-EU trade will trend downwards due to the falling trade barriers against the rest of the world, and the share of services exports will trend upwards due to the reduction in the relative prices of goods as their protection is dismantled. It can be seen from Figures 4 and 5 that both trends are visible in the current data.

Figure 1: charts of the UK data series

© Prof Patrick Minford 2023 - click to enlarge

© Prof Patrick Minford 2023 - click to enlarge

Progress in restoring UK-based regulation

It can be seen from this trade analysis that the UK will be unrestricted in its ability to restore UK-based regulation once free trade around the world is created. Meanwhile there has been progress on this front on the ground.

The current Bill going through Parliament mandates the sunsetting of all remaining EU regulations by the end of 2023; while this target date has now been abandoned as too ambitious, it is reasonable to assume the sunsetting process will be completed in the next year or so. Particular areas have already seen major change, such as for the City of London in the ‘Edinburgh reforms’.

Existing regulations by now are also all the responsibility of UK regulators, under the direct control of Parliament. This will ensure that UK regulation is done by new UK processes supervised by UK law and regulators in consultation with UK industrial interests. The sunsetting intention forces these bodies to work urgently to find optimal UK replacements. One of the major objectives of Brexit is to replace the EU’s intrusive precautionary principle with the pragmatic common law principles under which experimentation is permitted to enable vigorous innovation. As long as EU regulations are left in place by default, their replacement is delayed by bureaucratic inertia. As nature abhors a vacuum, so the abolition of remaining EU regulations should stimulate the necessary consultations to produce new UK-based regulation.

The gains from this change in regulation were estimated at 6% of GDP using the supply-side of the UK model - see chapter 3 of my recent book.

Immigration

Opponents of Brexit feared that it would lead to a sharp reduction in immigration, causing shortages of labour across an economy facing an ageing and eventually declining population. However, this was never the intention and net immigration has increased since Brexit, and opened up entry to the UK to countries all over the world. While the labour market has tightened, this has been caused by the loss of home labour supply due to Covid.

The gains from this liberalisation were estimated in a recent paper - at 0.4% of average household disposable income. These consisted in stopping the inflow of unskilled labour with effects on the welfare of poorer households.

Conclusions

In this piece I have examined the evidence on the effects of Brexit on the UK, both short term and long term. For the short term we have estimated the Brexit effects found in the appropriate UK relationships. We find that there are temporary effects on GDP, exports and imports (slightly negative), and on inflation and interest rates (slightly positive). What we see is a set of fairly minor temporary effects, consistent with modest disruption from introducing a border with the EU- a border due to be made barrier-free and seamless by the UK-EU Trade and Cooperation Agreement. There has been enormous turbulence in the past few years in all economies due to Covid and the Ukraine war, besides accompanying large fiscal and monetary policy fluctuations. Brexit is one policy shift among many shocks, and estimating its effect is fraught with uncertainty. Economic theory suggests it will have had a disruptive effect on EU trade in the short run as businesses adapt to a new border and the resulting new paperwork and related processes. But the TCA is designed to create a barrier-free and seamless border; so we should expect this effect to be dissipated steadily- including in the future as the TCA is streamlined by new talks- and not to be permanent. This is consistent with these findings from the data.

The long term effects of Brexit based on ‘classical’ models of trade are much disputed by proponents of ‘gravity’ models of trade. We have surveyed the evidence for both types of model, implying the widespread rejection of gravity models on long term trade data, even if these models are useful as short term relationships like the ones just referred to. Our supply-side models predict similarly large gains from the introduction of common law-based regulation replacing EU Napoleonic-law-based regulation, as also from the liberalisation of UK immigration law focused on worldwide access for skilled immigrants.

Thus the overall conclusion from this exploration of Brexit effects on the UK is that while there has been some short term disruption due to the new UK-EU border; this should be temporary as the TCA eliminates trade barriers between the UK and the EU and free trade pushes UK trade towards world prices. Meanwhile the models that fit the data imply there should be substantial long term gains to the UK from free trade, regulatory reform and liberalised immigration.

By Professor Patrick Minford, Cardiff Business School, July 2023

The economists amongst our readership may access the full paper here.

Observations

Rejoiners are fond of saying the Office for Budget Responsibility have forecast that Brexit has cost the country 4% of GDP. No, that is not what the OBR said. Their Chairman actually told Laura Kuenssberg of the BBC in March :

“We think that, in the long run, [Brexit] reduces our overall output by around 4 per cent compared to had we remained in the EU.”

This is not a fall of 4%. He was predicting that the UK's economy would not grow as much over the next five years. Even then we are compelled to point out to Rejoiners that the OBR has a lamentable record at forecasting, as we have previously reported. If they can't even forecast numbers from one quarter to the next, how are we supposed to take their forecasts for the next five years seriously?

By contrast, Professor Minford - to whom we are grateful for this report - and his team see a long-term benefit arising from Brexit, provided we take advantage of our new freedoms. It is of course the latter point which is important. The Government and the Civil Service have been painstakingly slow in delivering the improvements which they could have made, now that the UK has left the European Union. The faster they move, the sooner we will see more of the benefits of Brexit.

We must get reports like this out there

Reports like the one above take far longer to research, write and produce than many people realise. If they were easy, readers would see other organisations also producing these daily. However, there’s little point in the Facts4EU.Org team working long hours, seven days-a-week, if we lack the resources to promote them effectively – to the public, to MPs, and to the media. This is where you come in, dear reader.

Facts4EU.Org needs you today

We are a 'not for profit' team (we make a loss) and any payment goes towards the actual work, not plush London offices, lunch or taxi expenses, or other luxuries of some organisations.

We badly need more of our thousands of readers to become members, to support this work. Could this be you, today? It's quick and easy, we give you a choice of two highly secure payment providers, and we do NOT ask you for further support if you pay once. We just hope you keep supporting us. Your membership stays anonymous unless you tell us otherwise.

Please don't assume that other people will keep us going - we don't receive enough to survive and we need your help today. Could you help us? We rely 100% on public contributions from readers like you.

If you believe in a fully-free, independent, and sovereign United Kingdom, please join now by clicking on one of the links below or you can use our Support page here. You will receive a personal, friendly ‘thank you’ from a member of our team within 24 hours. Thank you.

[ Sources: Prof Patrick Minford, Cardiff Business School, Cardiff University ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Fri 28 Jul 2023

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget to actually post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments