Yet more good news for Brexit as UK dominates EU in FinTech investment

In 2021 UK was larger than top four EU countries combined and ranked 2nd in World

Montage © Facts4EU.Org 2022

The UK on its own raised almost half of all the FinTech investment in the whole of Europe

Following on from our report yesterday on the City’s domination of business coming to the European markets through IPOs, there’s further good news about the performance of UK PLC and the City in particular, as the number of deals and their volume of investment in FinTech businesses was made public.

The UK was way out in front of the EU and a clear second in the World only to the US, with more than half of the top 20 deals and more total value than the top four EU countries combined.

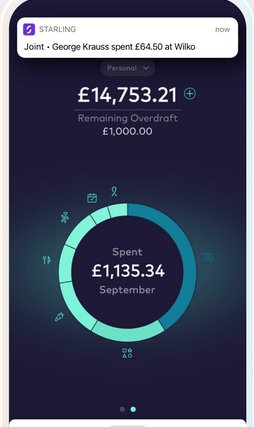

FinTech might sound technical, but in fact 79% of us are now using FinTech products (see below).

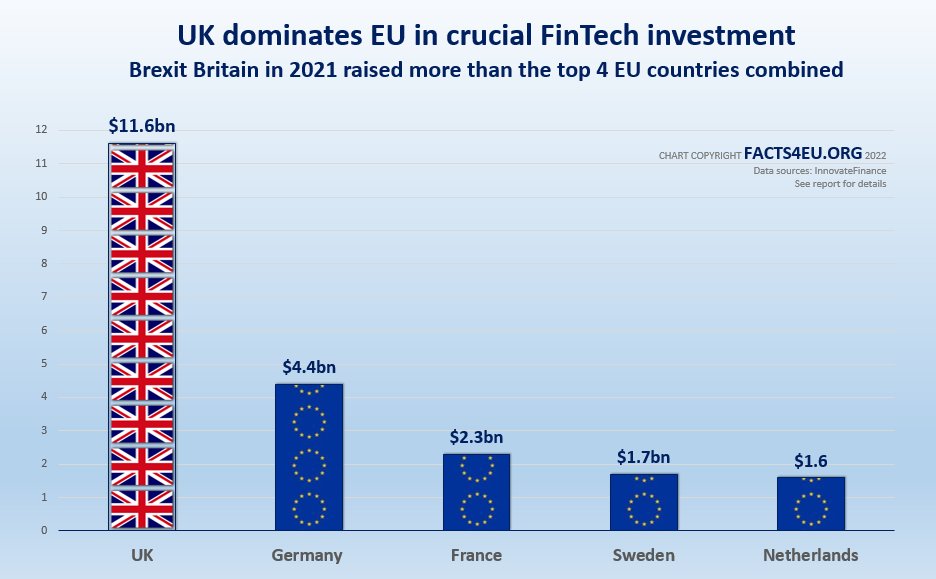

$24.3bn of investment was raised for FinTech companies across the European continent, with the UK’s $11.6bn representing nearly half (47.7%) of the total.

What is FinTech and how does it affect you?

Simply put, FinTech involves emerging industries that use technology to improve activities in financial services. Eight out of 10 of us now use FinTech products in our daily lives, according to research late last year from Plaid and the Harris Poll.

Consumer adoption of FinTech products has accelerated in the UK, partly due to the Covid-19 pandemic, with two-thirds of us now managing our finances online across an average of 2.8 products and services. Even more of us use it to make payments, or to invest or save, or for budgeting or borrowing.

Brexit Facts4EU.Org Summary

Top five European FinTech investment countries

Countries involved and investment raised ($ USD)

- UK : $11.6bn

- Germany : $4.4bn

- France : $2.3bn

- Sweden : $1.7bn

- Netherlands : $1.6bn

© Brexit Facts4EU.Org 2022 - click to enlarge

The UK raised 2.6 times the funding raised in Germany – our closest competitor – and outperformed the top four EU economies combined.

Government commends UK FinTech performance in 2021

Lord Grimstone, (unpaid) Minister for Investment, said:

“2021 was a first-class year for UK investment. We hosted the Global Investment Summit, which secured nearly £10bn investment into our industries of the future.

“And we proved that the UK fintech sector is more than a force to be reckoned with, maintaining our position as the number one fintech investment destination in Europe, and number two in the world, second only to the US.

“Thanks to our welcoming business environment and our world-class fintech ecosystem, we more than doubled 2020’s fintech inward investment figures, with more than 10% of deals worldwide landing on UK soil.

“A fantastic achievement with even more to come!”

More mega-deals than the rest of the EU countries combined

Of the World’s mega-deals (deals worth $100m+), 32 were from the UK. This is more than the 31 from the rest of the continent. Of the top 20 FinTech mega-deals in Europe, 13 were in the UK. Germany took second place with just three.

The tremendous news about growing FinTech investment is not just good for the City but shows how the private sector can drive the ‘levelling up’ the UK Government advocates. FinTech investment outside London and the South East was $696m in 2021 compared to $206m in 2020 – a staggering 237% increase.

UK outperforms the World trend

Cynics might think the numbers just reflect a presumed economic post-Covid bounce-back but that would be wrong. There were sustained periods of lockdowns and ‘circuit breakers’ or other restrictions across Europe in 2021 and no-one is out of the pandemic yet.

Yet for all those obstacles the UK outperformed World growth with 2021’s $11.6bn investment representing a growth of 217% over 2020 – against the World’s investment bringing a growth rate of ‘only’ 183%.

A leading FinTech lawyer and founder of Law Society award-winning Chronos Law,

Tom Bohills, commented exclusively to Facts4EU.Org:

“These figures are staggering. We were told time and time again that Brexit would destroy our burgeoning tech sector. In fact, as so often, quite the opposite has occurred.

“In our first year outside the EU, despite all the continuing challenges of Covid, UK Fintech investment has skyrocketed. Not only does the UK remain an inherently fantastic place to do business but post-Brexit reforms to regulation have clearly accelerated that change, allowing us to pull away from the rest of Europe at an even faster rate.

“On a personal note, our firm has seen a large uptick in EU based Fintechs looking not just to expand to the UK market, but to set up a meaningful well-staffed hub here. If the initial inquiries of 2022 are anything to go by, the UK will smash records again next year”

Just like our IPO report yesterday, at the time of writing the BBC has not yet covered the FinTech story.

Observations

We should never rest on our laurels and always strive to do better – but we should also never fail to tell the British people about our success stories because our competition are not going to do it for us.

If the BBC and other platforms for critics of our country would rather focus on our faults and the risks we face, then we at Facts4EU are more than happy to provide the counterbalance - but you won’t be forced to pay a tax for us doing that job. We only ask you to donate towards our work if you can, to keep us going.

The United Kingdom – a country of creativity and innovation

The UK’s unbelievable performance in raising FinTech investment for many of the companies of the future - like the railways were to the Victorians – shows what can be achieved by creativity, innovation and sheer hard work, and a helpful dash of our legal system being great for doing business.

While we can always expect the US to dominate because of its sheer size, it cannot be said often enough: the UK punches above its weight in many, many fields of commerce, culture and sport. Brexit is not always responsible for what we have achieved but we were told it would lead to our economic ruin and would damage every aspect of our economy.

Well, we can now see in the world of investment for companies coming to market (IPOs) and for investment in FinTech, we have not been held back but are in fact excelling.

With further regulatory changes to keep our best practice and processes business-friendly we should look forward to greater prosperity.... “despite Brexit”.

No licence fee, no paywall - but Facts4EU.Org needs your help today

We are a 'not for profit' team (we make a loss) and any donation goes towards the actual work, not plush London offices, lunch or taxi expenses, or other luxuries of some organisations.

There is no statutory licence fee keeping us going. Nor do we place our research behind a paywall. However we badly need more of our thousands of readers to donate. Could this be you, today? Maybe you've been thinking about it, but just haven't got around to doing it? If so, let us reassure you: it's quick, easy, and confidential, and we use two highly secure payment providers. Importantly we do NOT ask you for further donations if you donate once - we just hope that you will keep supporting us. Your donation stays anonymous unless you tell us otherwise.

Please don't assume that other people will keep us going - we don't receive enough to survive and we need your help today. Could you help us?

Most of our readers are well-informed and appreciate our fact-based articles, presented in a way you won't see anywhere else. If you value reports like the one above, please help our work with a donation. We have far more to do in researching, publishing, campaigning and lobbying Parliament than we have in terms of the financial resources to fulfil these tasks. We badly need funding to continue - we rely 100% on public donations from readers like you.

If you believe in a fully-free, independent, and sovereign United Kingdom, please make a donation now. It’s quick, secure, and confidential, and you can use one of the links below or you can use our Donations page here. You will receive a personal, friendly ‘thank you’ from a member of our team within 24 hours. Thank you for reading this.

[ Sources: Innovate Finance (trade body for the FinTech industry) | Plaid/Harris poll | Lord Grimstone of Boscobel Kt ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Fri 07 Jan 2022

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget to actually post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments