More good news as the City triumphs “despite Brexit”

New company listings such as Dr Martens put the boot into EU competitors

Montage © Facts4EU.Org 2022

After all the reported scaremongering the City proves the pessimists wrong

The amount raised from new company listings in the UK markets in 2021 was £13.9bn – almost three times 2020 and crucially more than three times higher than pre-pandemic 2019 – the last full year BEFORE the official Brexit.

New company listings included Dr Martens plc – which raised £1.3bn – and Deliveroo – which came top with £1.5bn raised.

Massive increase in numbers for the City after Brexit

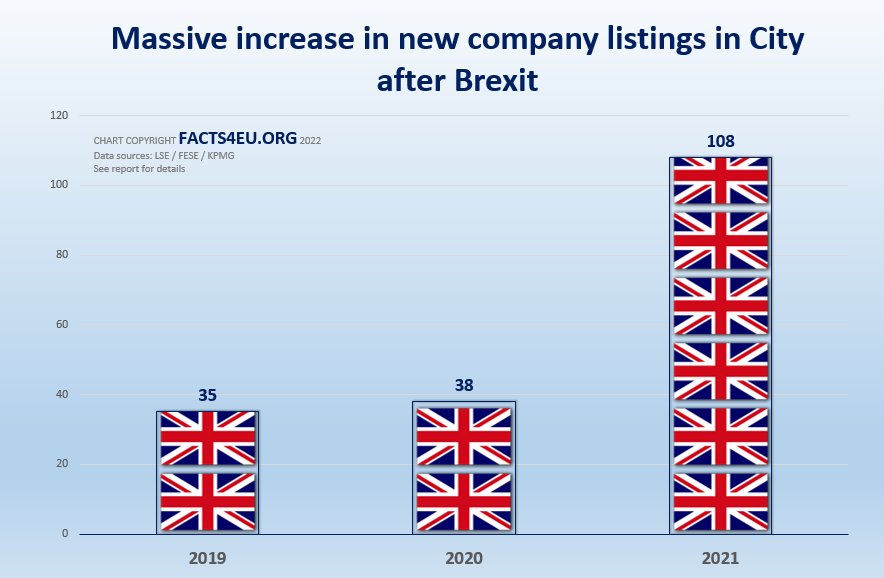

In 2019 only 35 companies listed in the City, while in 2020 that rose to 38 even during the pandemic – but these numbers were trounced by a whopping Brexit bonanza last year of 108 firms coming to market and raising nearly £14bn in capital via the City.

Brexit Facts4EU.Org Summary

New company listings in London's markets

Year and number of IPOs raised

- 2019 : 35

- 2020 : 38

- 2021 : 108

© Brexit Facts4EU.Org 2022 - click to enlarge

A total of 53 companies debuted on the City’s ‘main market’ of the London Stock Exchange, raising £11bn, against only 22 companies in 2020 and 25 in 2019. The remaining companies raised £2.9bn of capital on the junior market, AIM, with 55 companies in 2021, 16 in 2020 and 10 in 2019.

No time to relax

Now the Chancellor is helping the City beat last year’s numbers by introducing a new listing regime with rules especially designed to attract the fastest growing tech companies from around the world. City insiders insist such reforms must continue and at a faster rate, as other financial centres grow envious of the UK’s success.

Commenting on the City’s performance, Chancellor of the Exchequer Rishi Sunak said:

“It’s fantastic to see that the City remains one of the best destinations for firms to go public.”

He added that the new rules would make London:

“more open, more competitive, more technologically advanced, and more sustainable.”

Photo right: The Rt Hon Rishi Sunak MP

London's markets easily beat off EU competition

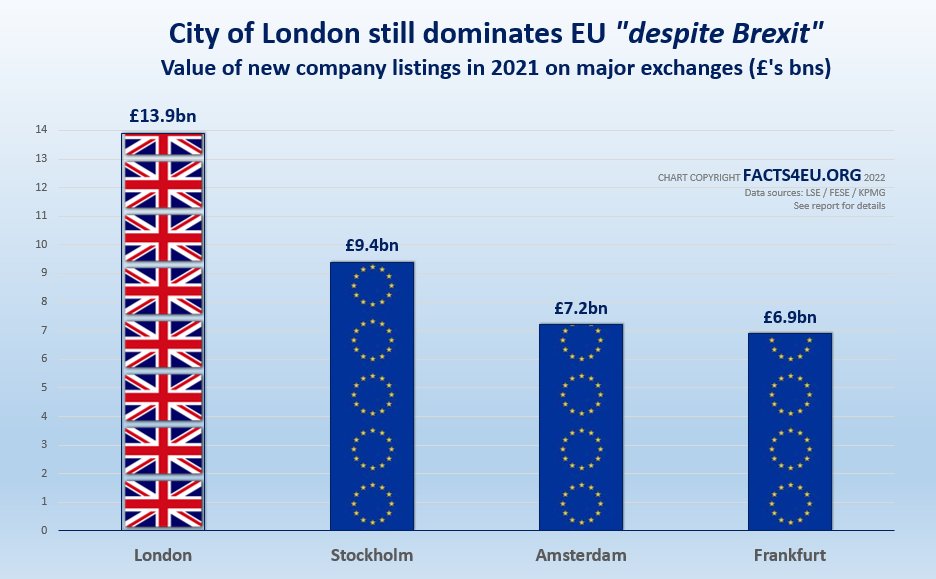

While the totals and the trend were good news for the economy and the Treasury, what was also significant was how the EU competition was left trailing despite so many Rejoiners talking-up a supposed and inevitable demise of the City.

Brexit Facts4EU.Org Summary

League table of top four European centres for Initial Public Offerings (IPOs)

Market used and funds raised

- London : £13.9bn

- Stockholm : £9.4bn

- Amsterdam : £7.2bn

- Frankfurt : £6.9bn

© Brexit Facts4EU.Org 2022 - click to enlarge

Now the Chancellor is helping the City beat last year’s numbers by introducing a new listing regime with rules especially designed to attract the fastest growing tech companies from around the world. City insiders insist such reforms must continue and at a faster rate, as other financial centres grow envious of the UK’s success.

A leading City figure commented exclusively to Facts4EU.Org. Professor Daniel Hodson is the Chairman of the CityUnited Project and The City for Britain, and he told us:

“The City leads a highly competitive global market, but with envious Continental rivals.

“Brexit gives it massive opportunities to secure its position with quick regulatory reform, but far greater urgency and priority is needed for the earliest possible launch of a wholesale Sterling Central Bank Digital Currency to protect its core payments and settlements system from a continuing EU onslaught, not least out of Paris.”

- Professor Daniel Hodson, Chairman of the CityUnited Project and The City for Britain; Vice Chairman of The Independent Business Network. Formerly Gresham Professor of Commerce, CEO of LIFFE, Deputy CEO of Nationwide Building Society, a director of the London Clearing House and the Post Office.

At the time of writing this story had not been found on the BBC website but had been covered by City AM and This is Money (Daily Mail).

Observations

The Remainers told us London was finished if we left the EU. Well the facts speak for themselves. If left alone by the politicians to get on and do business, the City can and will prosper.

Previously the real threats to the City were coming from the meddling of Brussels bureaucrats who were continuing to devise more regulations that would tie London in knots and make it less attractive against the real competition – New York, Singapore and Hong Kong – not Frankfurt, Paris or Amsterdam.

There is still work to be done, however. Markets can go up and markets can go down – and no financial centre can ever rest on its laurels. A thorough review of regulations and laws that hold back the City – and all other UK centres of financial services – is vital and the continued relaxation of unnecessary or outdated restrictions that impede business to no benefit of stakeholders needs to proceed.

2021 was only the start – we need to see further gains for the economy in 2022.

Facts4EU.Org needs you today

We are a 'not for profit' team (we make a loss) and any donation goes towards the actual work, not plush London offices, lunch or taxi expenses, or other luxuries of some organisations.

We badly need more of our thousands of readers to donate. Could this be you, today? Maybe you've been thinking about it, but just haven't got around to doing it? If so, let us reassure you. It's quick and easy and we use two highly secure payment providers. And we do NOT ask you for further donations if you donate once - we just hope that you keep supporting us. Your donation stays anonymous unless you tell us otherwise.

Please don't assume that other people will keep us going - we don't receive enough to survive and we need your help today. Could you help us?

Most of our readers are well-informed and appreciate our fact-based articles, presented in a way you won't see anywhere else. If you value reports like the one above, please help our work with a donation. We have far more to do in researching, publishing, campaigning and lobbying Parliament than we have in terms of the financial resources to fulfil these tasks. We badly need funding to continue - we rely 100% on public donations from readers like you.

If you believe in a fully-free, independent, and sovereign United Kingdom, please make a donation now. It’s quick, secure, and confidential, and you can use one of the links below or you can use our Donations page here. You will receive a personal, friendly ‘thank you’ from a member of our team within 24 hours. Thank you for reading this.

[ Sources: London Stock Exchange (LSE) | Federation of European Securities Exchanges (FESE) | KPMG ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Thur 06 Jan 2022

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget to actually post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments