EU Commission uses cover of Christmas to “cruise” to £320bn tax hike

UK narrowly escapes two new climate change taxes and a new business tax – massive increase in EU’s budget

Montage © Facts4EU.Org 2021

A Facts4EU.Org analysis reveals the extent of the tax raid by Brussels

Just before Christmas, the EU Commission led by Ursula von der Leyen revealed its plans to raise enormous sums indirectly from EU citizens and directly from companies via a series of new taxes.

The Commission will get its 27 member countries to raise the taxes and will then take a proportion of them for its own budget in Brussels.

This plan flows from the huge indebtedness incurred by the EU itself, as a result of the various measures it announced last year, which it calls “NextGenerationEU”.

As the Commission itself stated on 22 Dec 2021:

“the European Union agreed in 2020 on a record stimulus package of more than €2 trillion – boosting the long-term budget with more than €800 billion firepower of the temporary recovery instrument NextGenerationEU (in current prices).”

Christmas present for Ursula von der Leyen and her fellow Brussels bureaucrats

Facts4EU.Org has analysed the details released by the Commission in an effort to summarise the staggering tax increases which now lie ahead for the EU – taxes which the UK population would have borne a disproportionately high share of, had the UK not voted to leave the EU in 2016.

Brexit Facts4EU.Org Summary

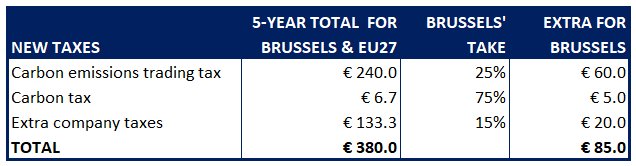

New taxes to be imposed by EU, all amounts in billions

© Brexit Facts4EU.Org - click to enlarge

Source: EU Commission documents, 22 Dec 2021

Christmas, Covid-19…. but above all ‘climate change’

On 22 Dec 2021 the EU Commission issued a series of announcements, just as UK and EU citizens were making last minute preparations for Christmas and also trying to understand the latest COVID-19 restrictions on their freedoms which were being imposed by governments across the EU and in the UK.

The key pre-Christmas announcements from the Commission involve three new taxes which will bolster EU finances to the tune of some £320bn over five years, and which will continue after that. Two of the three new taxes relate to the ‘climate change’ policies of the EU Commission.

The top policy priority set out by the EU Commission led by Ursula von der Leyen was and remains her ‘Green Deal’. This goes ahead of all other priorities for the EU Commission’s programme until 2027. It is therefore not surprising that the lion’s share (76.5%) of the new taxes for the Commission will come from the two new ‘carbon taxes’.

But… but… Doesn’t the EU Commission have to have a balanced budget?

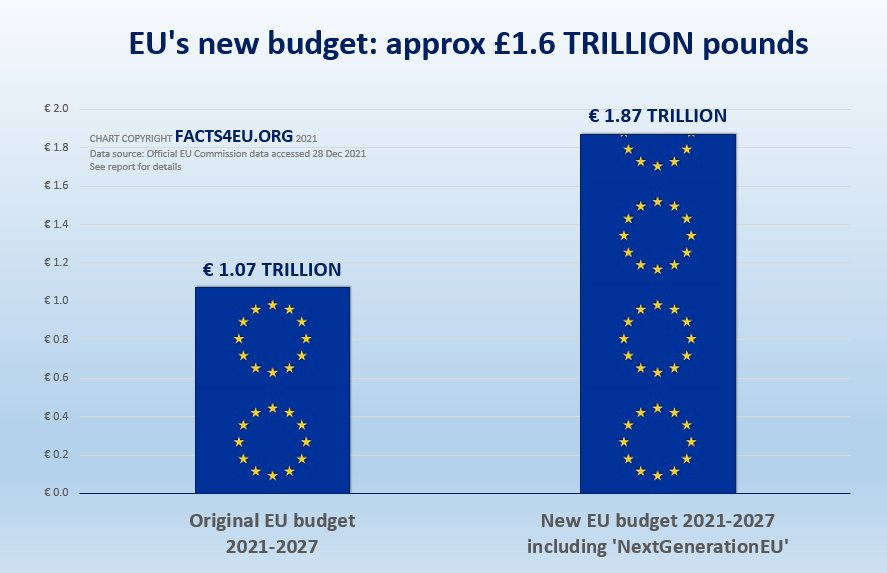

Until last year, in broad terms the EU’s expenditure had to be matched by its receipts. Its budget for the seven-year accounting period for 2021-2027 was agreed at more than €1 trillion (€1,074.3 billion). Last year, however, the Commission proposed a massive increase to enable it to distribute hundreds of billions of euros in response to the Covid crisis. This money all has to be borrowed.

Brexit Facts4EU.Org Summary

Dramatic increase in EU budget

© Brexit Facts4EU.Org - click to enlarge

Source: EU Commission documents, 22 Dec 2021

The EU27 governments agreed that in response to Covid the EU should be allowed to borrow substantial sums of money on the international bond market. The result has been a massive indebtedness for the EU as an entity, which now affects all member countries. The EU Commission states:-

“NextGenerationEU – the temporary recovery instrument of around €800 billion in current prices – is at the heart of the EU response to the coronavirus crisis. To finance the recovery, the European Commission – on behalf of the EU – is borrowing on the capital markets.”

- EU Commission website, extracted 27 Dec 2021

It doesn’t end there

The number of ‘financial instruments’ being deployed by the EU Commission and the ECB is now so extensive it is beyond our means to summarise them effectively for the average reader. For example in its statement the EU Commission says:

“Furthermore, the Commission will present a proposal for a second basket of new own resources by the end of 2023. This second package will build on the 'Business in Europe: Framework for Income Taxation (BEFIT)' proposal foreseen for 2023.”

- EU Commission statement, 22 Dec 2021

Above we have shown the latest demands which are now being proposed by the EU Commission, to be inflicted on businesses and on the prices which EU citizens will have to pay for certain goods. As further information becomes available we will endeavour to report it to readers.

Observations

‘Dear Santa, can we have £320bn for Christmas?’

Issued just two days before Christmas Eve when most normal people were preparing for the Christmas festivities, buying presents, and following the latest COVID-19 measures put in place by UK and EU governments in response to the ‘Omicron variant’, the EU Commission of Ursula von der Leyen wrote what in effect was a ‘Dear Santa’ letter.

She and her Commissioners are asking for a £320bn Christmas present from EU citizens and businesses.

The element which will be allocated to the EU Commission’s own budget in Brussels amounts to a ‘mere’ £85bn, but this is only a part of the overall bill which EU citizens and businesses will incur – directly or indirectly. Facts4EU.Org has tallied up the various elements of the new taxes and the total comes to €380bn (approx £320bn GDP). This sum is scheduled to be collected over five years, from 2026-2030, and will carry on from there.

We believe that some elements will in fact come into force by 2023, but the opacity of the EU’s statements makes this impossible to confirm during the festive season.

“At cruising speed”

In its statement the Commission twice used an expression we do not recall it using before: “At cruising speed”. We can only imagine this is a new verbal construction designed to obscure the ramp-up of the Commission’s tax take, ahead of the full siphoning from member countries in 2026.

“At cruising speed, in the years 2026-2030, these new sources of revenue are expected to generate on average a total of up to €17 billion annually for the EU budget.”

One of the key aspects of these new proposals is not only the taxes themselves, but the large percentages of them which member countries will be required to hand over to Brussels. Ranging from 15% to 75%, these are unprecedented proportions which EU27 governments will have to collect, only to pass them to Mrs von der Leyen and her Commission.

It will be interesting to see how EU27 governments respond – particularly those which are currently the subject of EU Commission legal action.

Facts4EU.Org needs you today

We are a 'not for profit' team (we make a loss) and any donation goes towards the actual work, not plush London offices, lunch or taxi expenses, or other luxuries of some organisations.

We badly need more of our thousands of readers to donate. Could this be you, today? Maybe you've been thinking about it, but just haven't got around to doing it? If so, let us reassure you. It's quick and easy and we use two highly secure payment providers. And we do NOT ask you for further donations if you donate once - we just hope that you keep supporting us. Your donation stays anonymous unless you tell us otherwise.

Please don't assume that other people will keep us going - we don't receive enough to survive and we need your help today. Could you help us?

Most of our readers are well-informed and appreciate our fact-based articles, presented in a way you won't see anywhere else. If you value reports like the one above, please help our work with a donation. We have far more to do in researching, publishing, campaigning and lobbying Parliament than we have in terms of the financial resources to fulfil these tasks. We badly need funding to continue - we rely 100% on public donations from readers like you.

If you believe in a fully-free, independent, and sovereign United Kingdom, please make a donation now. It’s quick, secure, and confidential, and you can use one of the links below or you can use our Donations page here. You will receive a personal, friendly ‘thank you’ from a member of our team within 24 hours. Thank you for reading this.

[ Sources: EU Commission ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Tues 28 Dec 2021

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget to actually post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments