EU introduces minimum company tax rate which is 40% less than the UK’s

What on earth are Rishi Sunak and Jeremy Hunt thinking?

© Brexit Facts4EU.Org 2021

Facts4EU asks how the UK’s economy can compete, with such high taxes in Brexit Britain

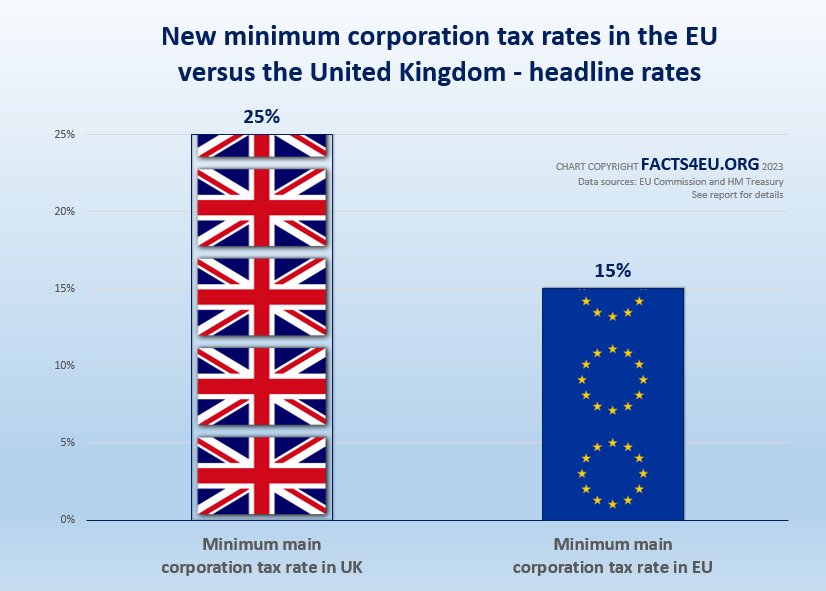

On 01 Jan 2023 the EU Commission announced the introduction of a minimum corporation tax rate of just 15%. The UK’s Chancellor, Jeremy Hunt, has increased the UK’s rate from 19% to 25%.

In the Spring 2021 Budget the then Chancellor, Rishi Sunak, announced a major reform to the corporate tax regime, putting up company taxes by 30%. On 23 September 2022, as part of the Government’s Growth Plan, Liz Truss’s then Chancellor Kwasi Kwarteng announced the increase in the main corporation tax rate from 19% to 25% would be cancelled.

The following month the new Chancellor Mr Hunt ruled that the basic rate of corporation tax would increase to 25% for all companies of any size, and to 19% for smaller operations. This applied from April 2023.

Both of these decisions will have had an impact on all business operations in the United Kingdom, affecting investment and jobs.

How can agile Brexit Britain be so much less attractive than the cumbersome EU?

It is important to note that the EU has set minimum corporation tax rates at 15%. This is in line with the new OECD rules. It does not enforce this rate for those EU member countries which have higher rates. Nevertheless this is an important decision.

“Ground-breaking new EU rules come into effect today introducing a minimum rate of effective taxation of 15% for multinational companies active in EU Member States.”

“The framework will bring greater fairness and stability to the tax landscape in the EU and globally, while making it more modern and better adapted to today's globalised, digital world.”

“While almost 140 jurisdictions worldwide have now signed up to those rules, the EU has been a front-runner in translating them into hard law. By lowering the incentive for businesses to shift profits to low-tax jurisdictions, Pillar 2 curbs the so-called "race to the bottom" - the battle between countries to lower their corporate income tax rates in order to attract investment.”

- EU Commission statement, 01 Jan 2024

Brexit Facts4EU.Org Summary

Minimum corporation tax rates in the EU versus the United Kingdom

Headline rates

- EU : 15%

- UK : 25%

[Sources : EU Commission and HM Treasury.]

© Brexit Facts4EU.Org 2023 - click to enlarge

“This new year marks a new dawn for the taxation of large multinationals. The entry into force in Europe and in jurisdictions around the world of this historic reform marks a major step towards a fairer corporate taxation system. By lowering the incentive for businesses to shift profits to low-tax jurisdictions, the new rules will help curb the so-called ‘race to the bottom’ on corporate tax rates in the EU and globally.

“I encourage all signatories to the global tax agreement to walk the talk and also enact swiftly this key reform, which has the potential to generate an extra $220 billion annually to help countries around the world to fund crucial investments and high quality public services.”

- Paolo Gentiloni, EU Commissioner for Economy – 01 Jan 2024

Observations

In a highly competitive global world, the main level of corporation tax in any country sends a very clear message to companies considering where to invest next, in siting their manufacturing or services operations.

Yes, Jeremy Hunt has made changes to things like capital allowances but these are not the headline figures which grab attention. It is the main level of corporation tax which signals how much a country is open for business. The EU Commission's latest move is designed to prevent countries such as Ireland from gaining a competitive advantage by offering corporation tax rates as low as 12%. Nevertheless, this new law prescribes 15% as the minimum rate and this is what the UK should be offering if it wishes to attract global businesses.

Facts4EU.Org desperately needs funds to continue

We are a 'not for profit' team (we make a loss) and any payment goes towards the actual work, not plush London offices, lunch or taxi expenses, or other luxuries of some organisations. There’s little point in the Facts4EU.Org team working long hours, seven days-a-week, if we lack the resources to promote these reports effectively – to the public, to MPs, and to the media.

We badly need more of our thousands of readers to become members, to support this work. Could this be you, today? It's quick and easy, we give you a choice of two highly secure payment providers, and we do NOT ask you for further support if you pay once. We just hope you keep supporting us. Your membership stays anonymous unless you tell us otherwise.

Please don't assume that other people will keep us going - we don't receive enough to survive and we need your help today. Could you help us? We rely 100% on public contributions from readers like you.

If you believe in a fully-free, independent, and sovereign United Kingdom, please join now by clicking on one of the links below or you can use our Support page here. You will receive a personal, friendly ‘thank you’ from a member of our team within 48 hours. Thank you.

[ Sources: EU Commission | HMG ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Fri 05 Jan 2024

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget to actually post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments