Brexit pound regains all lost ground after market over-reaction to Kwasi’s quasi-budget

Meanwhile, Euro has plunged 15% against US Dollar in the last 12 months

Montage © Facts4EU.Org

Facts4EU.Org and CIBUK.Org reveal more uncomfortable truths for the doom-mongers

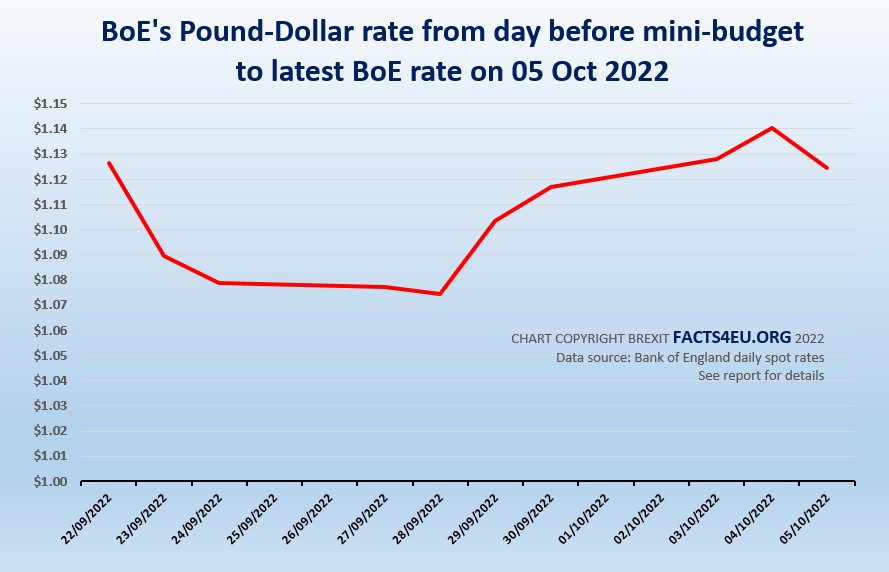

The TV broadcasters and other media have been full of negative stories since Chancellor Kwasi Kwarteng’s mini-budget on 23 September. One of the most prolific of these doom-laden narratives was the fall in the value of the pound.

Now (at the time of writing) the pound is back to the same level it was at before the mini-budget. Facts4EU.Org thought readers might like to know this and the official facts are below.

Brexit Facts4EU.Org Summary

Pound-dollar exchange rate – Bank of England daily spot rate

Latest data at time of writing, from the day prior to the Chancellor’s mini-budget

© Brexit Facts4EU.Org 2022 - click to enlarge

[Source: Bank of England daily spot rates, pound-dollar.]

Commenting exclusively on our report today, former Secretary of State and former Single Market Minister, the Rt Hon Sir John Redwood MP, said:

The government’s media critics blame it for the pound falling but don’t praise it when the pound rises. They ignore the way the Euro and yen have also fallen against the dollar.

They are political campaigners, not reporters of the facts. They just represent the anti-growth coalition that wants to bring down the government.

- The Rt Hon Sir John Redwood MP, Fri 07 Oct 2022

Floating exchange rates mean the pound fluctuates on a daily basis

Exchange rates move all the time. They do so for all manner of reasons. Often a change in the value of the pound has nothing to do with the intrinsic value of the pound, but because of a change in the perception of the other currency, in this case the US dollar.

For example, if the markets suspect the Federal Reserve will once again increase interest rates in the US, the dollar will gain in value because money goes where it can get the best return. If the dollar rises, the pound falls in relative terms.

It is also the case that at times of international crises there is a tendency to invest in the main reserve currency, which is the dollar. Putin’s illegal invasion of Ukraine has most definitely had an impact in the markets.

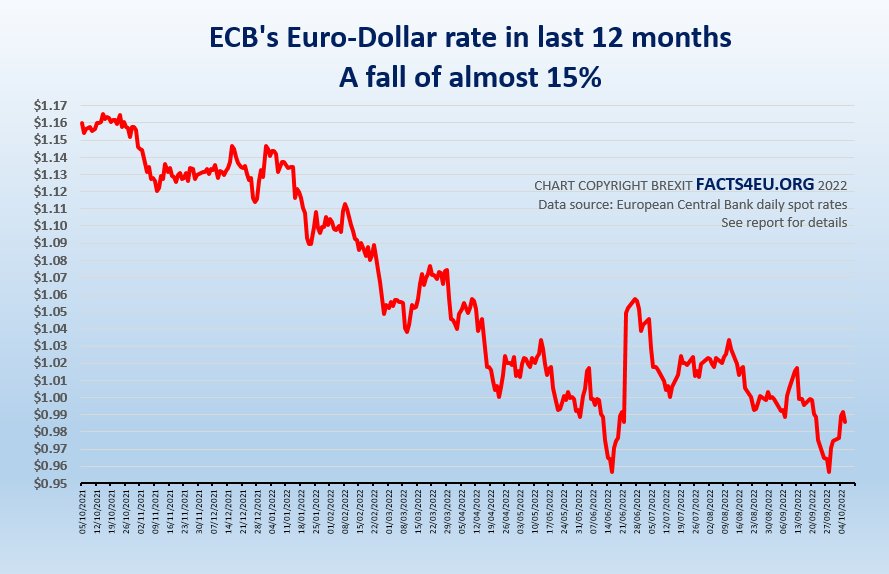

The euro has fallen 14.7% against the US dollar in the last 12 months

Both the pound and the euro have been on a steady downward trajectory against the US dollar for a long time. This started well before Liz Truss became Prime Minister.

The pound may have suffered, but so has the euro. Below we show the fall in the value of the euro against the US dollar over the past 12 months.

Brexit Facts4EU.Org Summary

Euro-dollar exchange rate in last 12 months

© Brexit Facts4EU.Org 2022 - click to enlarge

[Source: European Central Bank.]

Observations

Facts4EU.Org - like the umbrella organisation to which we are affiliated, CIBUK - remains non-partisan. We have no allegiance to any particular political party and our focus is on seeing the United Kingdom achieve the full independence, sovereignty, and freedoms which people voted for in the EU Referendum of 2016.

Sometimes our reports will overlap with political events. For example it is impossible to avoid the recent changes in the leadership of the Conservative Party and the effects of these.

The value of the pound transcends party political considerations but where it becomes part of the anti-Brexit narratives of large parts of the media we feel obligated to redress the balance with facts, as we have done above.

We have also put the pound into context with the euro, which has also decreased in value against the US dollar in the past 12 months, albeit by not as much as the pound.

When did readers ever see a headline saying “Euro has plunged 15% against the dollar in the last 12 months”? Yet this is what has happened.

And no, they can’t blame Brexit for this one.

Facts4EU.Org needs you today

We are a 'not for profit' team (we make a loss) and any payment goes towards the actual work, not plush London offices, lunch or taxi expenses, or other luxuries of some organisations.

We badly need more of our thousands of readers to become members, to support this work. Could this be you, today? Maybe you've been thinking about it, but just haven't got around to doing it? If so, let us reassure you. It's quick and easy and we use two highly secure payment providers. And we do NOT ask you for further support if you pay once - we just hope that you keep supporting us. Your membership stays anonymous unless you tell us otherwise.

Please don't assume that other people will keep us going - we don't receive enough to survive and we need your help today. Could you help us?

Most of our readers are well-informed and appreciate our fact-based articles, presented in a way you won't see anywhere else. We have far more to do in researching, publishing, campaigning and lobbying Parliament than we have in terms of the financial resources to fulfil these tasks. We badly need funding to continue - we rely 100% on public contributions from readers like you.

If you believe in a fully-free, independent, and sovereign United Kingdom, please join now. It’s quick, secure, and confidential, and you can use one of the links below or you can use our Support page here. You will receive a personal, friendly ‘thank you’ from a member of our team within 24 hours. Thank you for reading this.

[ Sources: Bank of England | European Central Bank | The Rt Hon Sir John Redwood MP ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Fri 07 Oct 2022

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget to actually post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments