Trapped in the EU? Poorer states are now ensnared in debt to the EU Commission

Did Brexit happen in the nick of time?

© Brexit Facts4EU.Org 2021

Is the EU’s “generosity” a clever tactic to ensure states can never leave?

€90 billion of loans have been approved to 17 countries who will now be in hock to the EU for years. A further €750 billion is set to be announced later this year.

On Tuesday (30 Mar 2021) the EU Commission disbursed a further €13bn to six member states as part of a €100bn loan scheme to combat the economic effects of the Coronavirus. This is all money that the EU Commission has had to borrow by issuing bonds on the ‘Luxembourg Green Exchange’ – part of the Luxembourg Stock Exchange.

The member states who have received this money will now be in hock to the EU Commission itself.

Who has racked up debt to the EU so far, and how much did they get?

So far the Commission has proposed a total of €94.3 billion in financial support to 19 Member States, out of which the EU Council has already approved €90.6 billion.

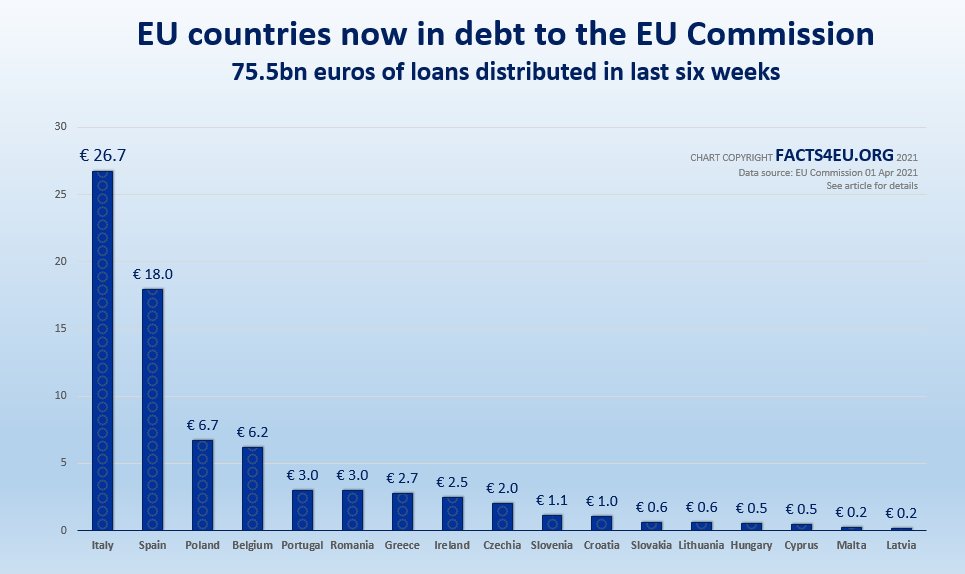

In the last six weeks €75.5 billion of this has already been disbursed to 17 Member States. Other Member States can still submit requests to receive financial support under this particular mechanism up to an overall limit of €100 billion.

Brexit Facts4EU.Org Summary

Who got what in the last six weeks? (In billions of euros)

- Italy € 26.7

- Spain € 18.0

- Poland € 6.7

- Belgium € 6.2

- Portugal € 3.0

- Romania € 3.0

- Greece € 2.7

- Ireland € 2.5

- Czechia € 2.0

- Slovenia € 1.1

- Croatia € 1.0

- Slovakia € 0.6

- Lithuania € 0.6

- Hungary € 0.5

- Cyprus € 0.5

- Malta € 0.2

- Latvia € 0.2

© Brexit Facts4EU.Org - click to enlarge

Who is guaranteeing these loans?

Loans provided to Member States under the SURE device are underpinned by guarantees from Member States. Each Member State’s contribution to the overall amount of the guarantee corresponds to its relative share in the total gross national income of the European Union, based on the 2020 EU budget.

If the UK had still been a member of the EU, it seems inevitable that it would have provided the second-largest guarantee.

What is the “SURE” device which the EU Commission is using?

The “temporary Support to mitigate Unemployment Risks in an Emergency” (SURE) is available for Member States that:

“need to mobilise significant financial means to fight the negative economic and social consequences of the coronavirus outbreak on their territory. It can provide financial assistance up to €100 billion in the form of loans from the EU to affected Member States to address sudden increases in public expenditure for the preservation of employment.”

- EU Commission, 30 Mar 2021

The SURE loan device is just a small part of the EU’s increasing global indebtedness

Later this year, the Commission is also due to launch €750bn of additional borrowing under NextGenerationEU, which the EU Commission describes as a “recovery instrument to help build a greener, more digital and more resilient Europe.”

Observations

And so it begins – another ratchet in the EU’s power grab

The EU Commission was previously never allowed to borrow, under the EU Treaties. All this changed last year, when the Commission used the Covid crisis and persuaded the EU Council to let it start racking up truly historic levels of debt.

The ‘SURE’ scheme outlined above is but the tip of the iceberg. It represents only one-tenth of what the EU Commission will be borrowing soon, in order to lend to member countries and increase their levels of indebtedness to Brussels.

No-one doubts the need for countries to borrow money to shore up their financing of Covid measures. The UK has certainly done this.

Nevertheless – and call us cynical – the simple fact is that EU countries are now starting to be in debt to the EU itself (outside of the normal annual budget), which begs the question of the political nature of all of this. The Commission used the Covid crisis to assume control of the most important area of public health and in effect to take it away from member countries. The resultant vaccination programme has been what can only be described as a proverbial pig’s ear, as we outlined in our last report here.

If readers would like further evidence of the political nature of all of this, they might question why the EU Commission chose to launch its bonds (debt instruments) on Luxembourg’s ‘Green Stock Exchange’. What on earth does this debt have to do with green issues? Clearly the EU thought this would sound good and no-one would ask....

Well, Facts4EU.Org is asking.

Where would we be without you, our readers?

Producing reports like the one above take time and they are unique. No-one at the BBC seems to be the least bit interested in investigating and revealing information like this to the public. If fighting for British sovereignty and freedom is important to you, please read on.

We are most grateful to readers who have donated so far this year, but we badly need more readers to do the same if we are to continue in our sixth year - researching facts, scrutinising, publishing, and lobbying MPs. Quick, secure, and confidential donation links are below this article, or you can use our Donations page here. 10 readers donating £500 per month, or 50 readers donating £100 per month, or 1000 readers donating £5 per month - on top of the one-off donations and monthly donations we currently receive, this would just about keep us going. If you have never donated before, please, please, keep us going with a donation now. Thank you so much. You will receive a personal 'thank you' email from a member of the team, but you will not be badgered by us for more funds, unlike some organisations!

[ Sources: EU Commission | Luxembourg Stock Exchange ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Good Friday, 02 Apr 2021

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget to actually post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments