EXCLUSIVE: “Even with a trade deal the UK will remain the EU’s dumping ground”

The first readable summary of the EU’s ‘level playing field’ economic hypocrisy

© Brexit Facts4EU.Org 2020

Professor David Blake explains it in everyday language for MPs and ordinary voters

A Brexit Facts4EU.Org two-part special, with the second part tomorrow (Saturday)

This two-part article is about the euro and how the EU has used it to benefit the 19 Eurozone countries – especially Germany – and to damage the UK. In the piece below, Professor Blake turns a bright, Brexit light on the EU's demands for a 'level playing field'.

Let’s face it, articles dealing with the economics of Brexit can be a bit dry and inaccessible for most of us. Here’s one by an expert that is presented in language we can all understand – and the subject matter is important.

Brexit Facts4EU.Org Summary

In Professor Blake's article below he explains :

- How the EU’s Euro currency has been used to dump its goods at artificially-reduced prices onto the UK and world markets for years

- How this has increased the massive trade deficit which the UK has with the EU

- How Germany has benefited most of all

Tomorrow (Saturday), Professor Blake explains:

- The risks of the Euro to the UK and the World

- The opportunities for Brexit Britain to counter the threat and deal with it

About the author: David Blake is Professor of Finance at City, University of London, and is a member of Economists for Free Trade. He has been published regularly in the Daily Telegraph, Financial News, City AM, CAPX, and others, and is writing here in a personal capacity.

“Even with a trade deal the UK will remain the EU’s dumping ground”

By Professor David Blake, 04 Dec 2020

© Brexit Facts4EU.Org 2020

The European Union is seeking a ‘level playing field’ with the UK after Brexit. One of the key issues concerning the EU is ‘dumping’. It is worried that the UK will become a super-competitive, de-regulated ‘Singapore-on-Thames’, undercutting the prices of products produced in the EU in the same way China does globally.

In fact the opposite is the case. It is the nineteen EU member states operating a single currency, the euro, that are dumping their goods onto world markets ‒ in particular the UK ‒ because the euro is a structurally undervalued currency.

The scary truth about the euro

The global economic and financial community regards the euro as ‘just another currency’. It is not.

Firstly, it is 'incomplete'. Unlike every other currency, there is no single sovereign standing behind it. Each member state stands behind the euro only to a certain percentage and collectively the member states do not share joint-and-several liability for each other’s national debts. This makes them 'sub-sovereign' members of the Eurozone (EZ).

This is very different from what happens in fully sovereign states, like the UK and US, where their central banks and Treasury departments stand fully behind the bonds issued by their governments and can, if necessary, print enough money to pay off their national debts. The European Central Bank does not have the legal power to do this.

Secondly, it is an artificially-constructed currency, as a consequence of the fixed rates used in 1999 to convert the domestic currencies of EZ members into euros. This affected not only the internal exchange rates between the EZ members, but also the international value of the euro.

The net result has been a downward bias in the international trading value of the euro, with the inefficient southern member states dragging down the value of the euro relative to what it would be if all member states were as efficient as Germany and the Netherlands.

How the artificially-undervalued euro has damaged the UK

The euro is undervalued against sterling on a purchasing power parity (PPP) basis and has been all of the time since its introduction. The UK has almost always run a trade deficit with the EU over the period of its EU membership, but the deficit worsened considerably after the euro was created.

In 2019, the UK’s trade deficit with the EU was £73bn and the ratio of exports to imports was only 80%: for every £1 of goods and services we buy from them, they only buy £0.80 from us.

We know that Germany is desperate for a trade deal with the UK

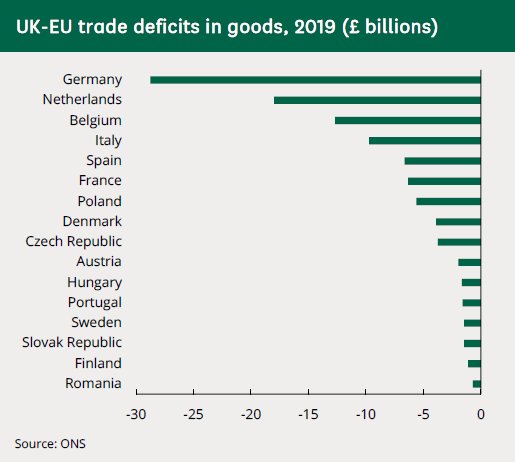

Looking at its massive trade surplus with the UK we know why. The chart below shows that in 2019 the UK had a trade deficit in goods with 16 EU member states. Germany leads the list with £29bn, mainly in automobiles. Even allowing for potential quality differences between British and German cars, a key explanation is again the undervaluation of the euro. Germany's trade surplus is, of course, our trade deficit.

© House of Commons Library: Research briefing 10 Nov 2020, 'Statistics on UK-EU Trade'

If the UK maintains the close economic ties with the EU that the EU wants, the UK will remain a captive market for German and other EZ member goods and will be unable to address the structural disadvantage which it finds itself in.

The UK could impose an anti-dumping duty of over £65bn on the protectionist EU

The euro is undervalued against sterling by 15-20% on a PPP basis. Had the euro been correctly valued, then EZ exports to the UK in 2018 would have been lower by between £67.2bn and £88.4bn. The UK would therefore be entitled to impose an annual anti-dumping duty on the EZ in this range.

The EU is following a classic 'beggar thy neighbour' strategy. This is where a country or trading bloc follows a protectionist trade strategy that adversely affects its trading partners.

Typically, this involves tariffs and quotas, but in this case the EU’s weapon is a structurally undervalued currency.

Part One of a two-part article by Professor David Blake

Don’t miss Part Two in the Saturday edition of Facts4EU.Org (tomorrow),

where the author suggests solutions.

Note: This two-part series is the result of a collaboration between Facts4EU.Org and Professor Blake with the aim of publishing a short and accessible version of his much longer academic paper. The full version of Professor Blake's 23-page paper can be found here or here.

Observations

The end game

We are now entering the end game for the UK-EU trade talks. No-one involved in the negotiations will give a new deadline (as so many have been missed already) but a deal or no-deal is expected to be announced in the coming days. The outline of any deal could be known as early as Monday.

Should a fudged trade deal be announced, one of the key elements which we shall be investigating will be the EU's 'red-line' issue of the 'level playing field'. Will the UK Government sign up to terms which constrain the UK's freedom to legislate as it sees fit in the interests of its businesses and citizens, or will it be constrained by EU procedures and 'standards' under the terms of any 'trade deal'?

What level playing field?

In the article above - and in the second part which follows tomorrow - Professor Blake demonstrates that the UK has been battling on a grossly-distorted playing field with the EU for years. In effect, the UK has been the biggest dumping ground for the EU's goods, thanks to the structurally-undervalued euro currency.

Professor Blake and other senior economists have been working to get this message out to MPs and voters for a long time, but articles about economics have never been a easy sell. Just ahead of any fudged deal (or no deal), we hope that our work with Professor Blake will shed some light on this important subject for the first time, allowing everyone to judge the outcome on some facts.

Finally, as ever we must appeal for your help to keep going. Covid and its impacts have hit the level of donations we receive. If you can, (and especially if you have never donated to us in the last five years), please make a donation today, no matter how small. We rely 100% on the generosity of people like you. Quick, secure, and confidential donation links are below. Thank you so much.

[ Sources: Professor David Blake ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Fri 04 Dec 2020

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget to actually post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments