News from the EU to cheer up Liz Truss after a tough week

Eurozone inflation is the highest since records began, according to the EU

Montage © Facts4EU.Org

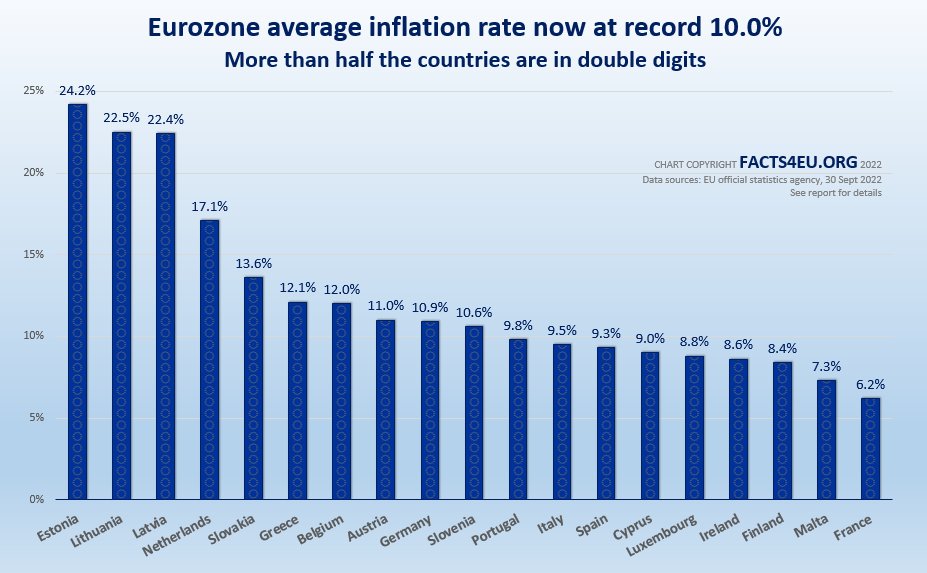

10 of the 19 Eurozone countries now have double-digit inflation – latest figures

Yesterday’s flash figures from the EU’s statistics agency make for interesting reading if you are a Brexiteer. Inflation in the supposedly mighty Eurozone averaged 10% in the year to September - the highest in the 25 years since records began.

As if this weren’t enough to cheer up Liz Truss after a tough week, the pound has recovered almost all of its lost ground since Kwasi Kwarteng’s mini-budget just over a week ago, and in addition yesterday the ONS revised its GDP figures to show the UK economy grew last quarter, instead of falling as it had previously said.

Remember when leaving the EU was supposed to result in the UK’s economy falling off a cliff? Well, we are navigating choppy waters as a result of Covid and the energy crisis, but the UK economy compares favourably with most EU countries.

Brexit Facts4EU.Org Summary

Yesterday's economic figures from the EU

- More than half of all Eurozone countries now have double-digit inflation

- In three of these, inflation is running at over 20%

- Even the EU’s economic powerhouse Germany is now at 10.9%

- Highest Eurozone inflation figures for 25 years, since records began

- Germany’s economy has flat-lined, with recession forecast

[Sources: EU’s statistics agency Eurostat | Germany’s statistics agency Destatis.]

© Brexit Facts4EU.Org 2022 - click to enlarge

What is driving these runaway prices?

The countries with the highest inflation rates generally have or had a high dependence on Russian gas, oil, and coal. Countries such as France have always relied far more on nuclear power. In addition the French government has a history of large subsidies and state aid.

Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in September (40.8%), followed by food, alcohol and tobacco (11.8%).

Liz Truss’s and Kwasi Kwarteng’s nightmare week improves

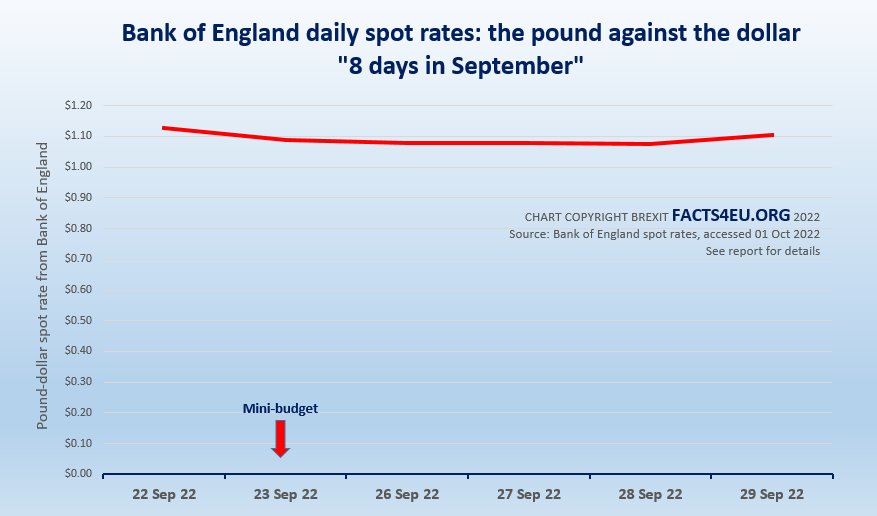

Much was made of the fall in the value of the pound during the week since the Chancellor’s mini-budget.

Most of this fall has now been recovered, as the markets digest the news that the UK’s economy did not contract in Q2, as had been reported by the Office for National Statistics. In fact it grew, confounding all the ‘experts’. The ONS issued a correction yesterday (30 Sept 2022).

Here is what happened to the pound-dollar spot rate from the day before the Chancellor’s mini-budget until yesterday.(For an explanation of why this doesn't look as serious as you thought, please read our 'Observations' below.

© Brexit Facts4EU.Org 2022 - click to enlarge

[Source: Bank of England, 01 Oct 2022.]

Observations

Firstly, it is not in the UK’s economic interests for the EU’s economies to be in trouble. We certainly wish them well.

That said, readers in the UK have been bombarded with terrible news all week, propagated by most of the media. Our report above attempts to provide some context, showing that inflation is surging across Europe and that the temporary fall in the value of the pound against the dollar has proved to have been overblown.

Ordinary people versus market traders

In regard to the exchange rate, we read reports that people were cancelling their plans to holiday in the USA as the drop in the pound made these unaffordable.

Facts4EU.Org therefore decided to produce a chart showing the actual changes. It is customary for news outlets to publish graphs with the baseline being way above zero, so as to accentuate any movements. Instead, we set the baseline at zero to show that the falls last week were not enough to deter people from taking holidays in the States.

Those who work in the financial markets look at changes of small fractions of a cent. Ordinary people are more interested in the overall picture, which is what we have provided above.

The simple fact is that the dollar is strong mostly as a result of the Fed’s aggressive rate rise policy. Investors go where they can get the highest returns, which means more demand for dollars, a higher dollar, and a lower pound and euro.

Yes, the pound has steadily been declining against the dollar over time, but so have the currencies of other european countries.

We’re in choppy waters, certainly, but let’s not talk ourselves down.

Facts4EU.Org needs you today

We are a 'not for profit' team (we make a loss) and any payment goes towards the actual work, not plush London offices, lunch or taxi expenses, or other luxuries of some organisations.

We badly need more of our thousands of readers to become members, to support this work. Could this be you, today? Maybe you've been thinking about it, but just haven't got around to doing it? If so, let us reassure you. It's quick and easy and we use two highly secure payment providers. And we do NOT ask you for further support if you pay once - we just hope that you keep supporting us. Your membership stays anonymous unless you tell us otherwise.

Please don't assume that other people will keep us going - we don't receive enough to survive and we need your help today. Could you help us?

Most of our readers are well-informed and appreciate our fact-based articles, presented in a way you won't see anywhere else. We have far more to do in researching, publishing, campaigning and lobbying Parliament than we have in terms of the financial resources to fulfil these tasks. We badly need funding to continue - we rely 100% on public contributions from readers like you.

If you believe in a fully-free, independent, and sovereign United Kingdom, please join now. It’s quick, secure, and confidential, and you can use one of the links below or you can use our Support page here. You will receive a personal, friendly ‘thank you’ from a member of our team within 24 hours. Thank you for reading this.

[ Sources: EU Commission | German statistics agency | Bank of England ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Sat 01 Oct 2022

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget to actually post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments